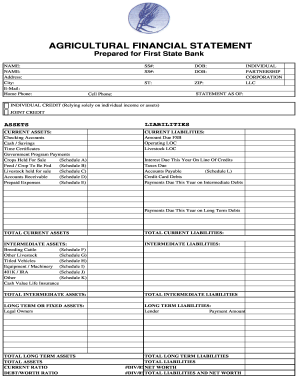

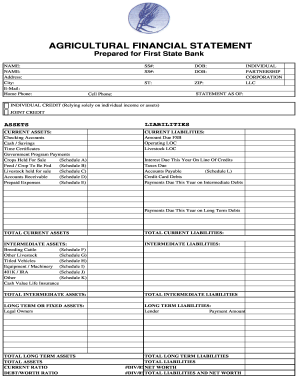

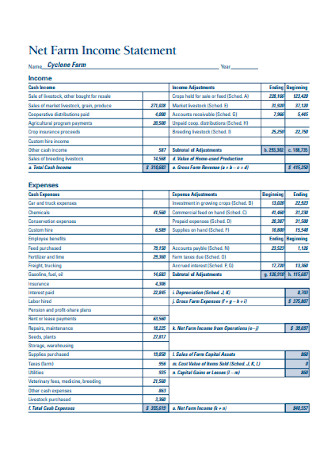

Get in-depth and timely insight on taxation, accounting, succession planning, and other issues specific to farmers and agribusiness processors. Subtract the beginning total of these items from the ending totals to find the net adjustment. Privacy policy, terms of use, and disclaimers Less than 3 percent is considered to be vulnerable. Record accounts payable so that products or services that have been purchased but not paid for are counted. The Minnesota certificate number is 00963. That gain might make it appear that the company is doing well, when in fact, theyre struggling to stay afloat. Our 1.67 current ratio in this example would be in the middle range. Accessed Feb. 26, 2021. Solvency, by definition, is the ability to pay off all debts if the business were liquidated. An important study can be made by comparing your return on assets to your return on equity. 0000032820 00000 n

But if the company sells a valuable piece of machinery, the gain from that sale will be included in the companys net income. The University of Minnesota is an equal opportunity educator and employer. Learn about cash flow statements and why they are the ideal report to understand the health of a company. It indicates the average percentage operating profit margin per dollar of farm production. You also have accounted for depreciation and changes in inventory values of farm products, accounts payable, and prepaid expenses. Most farmers will continue to retain their farmer status since their gross income from selling crops or livestock still should substantially offset the gains from trading in equipment. If your total expenses are more than your revenues, you have a negative net income, also known as a net loss. The rate of return on farm assets is calculated as income from operations less owner withdrawal for unpaid labor and management divided by average total farm assets. Copyright 1995-document.write(new Date().getFullYear()) The beginning and ending net worth statements for the farm are a good source of information about inventory values and accounts payable and receivable. Overview of How It's Taxed. 0000001056 00000 n

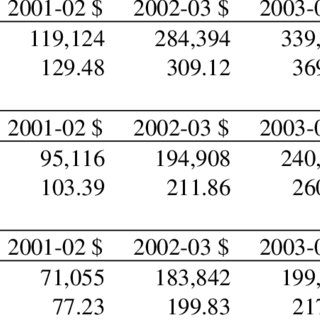

ISU Extension and Outreach publication FM1845/AgDM C3-55, Financial Performance Measures for Iowa Farms, contains information about typical income levels generated by Iowa farms. Lets say Wyatts Saddle Shop wants to find its net income for the first quarter of 2021. There are two methods used to figure out net farm income--cash accounting and accrual accounting. "2020 Schedule F (Form 1040)." If a significant difference exists, the records should be carefully reviewed for errors and omissions. August 02, 2011. Operating net income takes the gain out of consideration, so users of the financial statements get a clearer picture of the companys profitability and valuation.  In United States agricultural policy, gross farm income refers to the monetary and non-monetary income received by farm operators. Kathleen Kassel, Ag and Food Statistics: Charting the Essentials, The number of U.S. farms continues slow decline, Productivity growth is still the major driver of U.S. agricultural growth, U.S. gross cash farm income forecast to increase in 2022 but decrease in 2023, U.S. net farm income forecast to increase in 2022 but decrease in 2023, Corn, soybeans accounted for half of all U.S. crop cash receipts in 2021, Cattle/calf receipts comprised the largest portion of U.S. animal/animal product receipts in 2021, Most farms are small, but the majority of production is on larger farms, Most farmers receive off-farm income; small-scale operators depend on it, Privacy Policy & Non-Discrimination Statement.

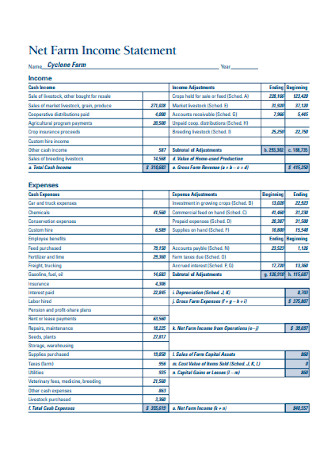

In United States agricultural policy, gross farm income refers to the monetary and non-monetary income received by farm operators. Kathleen Kassel, Ag and Food Statistics: Charting the Essentials, The number of U.S. farms continues slow decline, Productivity growth is still the major driver of U.S. agricultural growth, U.S. gross cash farm income forecast to increase in 2022 but decrease in 2023, U.S. net farm income forecast to increase in 2022 but decrease in 2023, Corn, soybeans accounted for half of all U.S. crop cash receipts in 2021, Cattle/calf receipts comprised the largest portion of U.S. animal/animal product receipts in 2021, Most farms are small, but the majority of production is on larger farms, Most farmers receive off-farm income; small-scale operators depend on it, Privacy Policy & Non-Discrimination Statement.  The depreciation deduction allowed on your income tax return can be used, but you may want to calculate your own estimate based on more realistic depreciation rates. Farm income refers to the money generated by farm or agribusiness operations. However, do include cash withdrawn from hedging accounts. 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. In the first quarter, your bakery had a net income of $32,000. A tax is hereby imposed on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States. Other financial software and paper forms products will generate similar measurements. The investment, labor, and management percentage alloca-tions for each enterprise were computed to be as follows: It shows how much cash was available for purchasing capital assets, debt reduction, family living, and income taxes. Net Farm Income from Operations CliftonLarsonAllen Wealth Advisors, LLC disclaimers. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Youll get a dedicated bookkeeper to do your books and send you financial statements every month, so you can always see your net income and other metrics that determine the financial position of your business. Write the inventory adjustments in the line below the gross income; this can be a positive or negative number. However, there is special relief in this case. It increases when you make more profit than you spend for consumption and income taxes, and it decreases when profits are insufficient. Get started with a free month of bookkeeping. However, do not include any items that already appear under cash expenses. Adjusting for inventory changes ensures that the value of farm products is counted in the year they are produced rather than the year they are sold. 0000050755 00000 n

Write the inventory adjustments in the line below the gross income; this

The depreciation deduction allowed on your income tax return can be used, but you may want to calculate your own estimate based on more realistic depreciation rates. Farm income refers to the money generated by farm or agribusiness operations. However, do include cash withdrawn from hedging accounts. 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. In the first quarter, your bakery had a net income of $32,000. A tax is hereby imposed on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States. Other financial software and paper forms products will generate similar measurements. The investment, labor, and management percentage alloca-tions for each enterprise were computed to be as follows: It shows how much cash was available for purchasing capital assets, debt reduction, family living, and income taxes. Net Farm Income from Operations CliftonLarsonAllen Wealth Advisors, LLC disclaimers. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Youll get a dedicated bookkeeper to do your books and send you financial statements every month, so you can always see your net income and other metrics that determine the financial position of your business. Write the inventory adjustments in the line below the gross income; this can be a positive or negative number. However, there is special relief in this case. It increases when you make more profit than you spend for consumption and income taxes, and it decreases when profits are insufficient. Get started with a free month of bookkeeping. However, do not include any items that already appear under cash expenses. Adjusting for inventory changes ensures that the value of farm products is counted in the year they are produced rather than the year they are sold. 0000050755 00000 n

Write the inventory adjustments in the line below the gross income; this  Agricultural production in the 21st century, on the other hand, is concentrated on a smaller number of large, specialized farms in rural areas where less than a fourth of the U.S. population lives. With good financial statements, excellent measurements can be made in: liquidity, solvency, profitability, repayment capacity and efficiency. University of Minnesota Extension discovers science-based solutions, delivers practical education, and engages Minnesotans to build a better future. Some cash expenses paid in one year may be for items not actually used until the following year. If forecasts are realized, GCFI would increase by 13.8 percent in 2022 relative to 2021 and then decrease by 6.9 percent in 2023 relative to 2022. It will improve the numbers and ratios and make life more comfortable, at least for a while. gross revenue - variable costs = gross margin + Net farm income is measure in a dollar value. Regents of the University of Minnesota. 0000025760 00000 n

If you have questions regarding individual license information, please contact Elizabeth Spencer. Another way of saying this is that for every $1 of assets that you have, you are contributing 56 cents of it, in the form of your net worth. In the FINPACK analysis, there is a cost measurement and a market measurement. grain) and keep as cash. So spend less time wondering how your business is doing and more time making decisions based on crystal-clear financial insights. Rate of return on farm equity is the interest rate your equity (net worth) in the business earned in the past year. Webqualify as farm income. Write any cash expenses from the farm under the gross income. 0000037519 00000 n

Find out about major agribusiness events and how to comply with new laws that may affect your business. 2. Add or subtract this number from the operation income. Greater than 45 percent is considered strong. Capital debt replacement margin is the amount of money remaining after all operating expenses, taxes, family living and debt payments have been accounted for. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. About 89 percent of U.S. farms are small, with GCFI less than $350,000; the households operating these farms typically rely on off-farm sources for the majority of their household income. WebGross farm income. Do not include noncash income such as profits or losses on futures contracts and options. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. There is no standard acceptable dollar amount for EBITDA, as the amount needed is tied to farm size and needs. Form 1040 is the standard U.S. individual tax return form that taxpayers use to file their annual income tax returns with the IRS. Net farm income is your measurement of farm profits. American agriculture and rural life underwent a tremendous transformation in the 20th century. It also illustrates other important measures and ratios that can help you evaluate the profitability, liquidity, and solvency of your own business over time. $20,000 net income + $1,000 of interest expense = $21,000 operating net income.

Agricultural production in the 21st century, on the other hand, is concentrated on a smaller number of large, specialized farms in rural areas where less than a fourth of the U.S. population lives. With good financial statements, excellent measurements can be made in: liquidity, solvency, profitability, repayment capacity and efficiency. University of Minnesota Extension discovers science-based solutions, delivers practical education, and engages Minnesotans to build a better future. Some cash expenses paid in one year may be for items not actually used until the following year. If forecasts are realized, GCFI would increase by 13.8 percent in 2022 relative to 2021 and then decrease by 6.9 percent in 2023 relative to 2022. It will improve the numbers and ratios and make life more comfortable, at least for a while. gross revenue - variable costs = gross margin + Net farm income is measure in a dollar value. Regents of the University of Minnesota. 0000025760 00000 n

If you have questions regarding individual license information, please contact Elizabeth Spencer. Another way of saying this is that for every $1 of assets that you have, you are contributing 56 cents of it, in the form of your net worth. In the FINPACK analysis, there is a cost measurement and a market measurement. grain) and keep as cash. So spend less time wondering how your business is doing and more time making decisions based on crystal-clear financial insights. Rate of return on farm equity is the interest rate your equity (net worth) in the business earned in the past year. Webqualify as farm income. Write any cash expenses from the farm under the gross income. 0000037519 00000 n

Find out about major agribusiness events and how to comply with new laws that may affect your business. 2. Add or subtract this number from the operation income. Greater than 45 percent is considered strong. Capital debt replacement margin is the amount of money remaining after all operating expenses, taxes, family living and debt payments have been accounted for. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. About 89 percent of U.S. farms are small, with GCFI less than $350,000; the households operating these farms typically rely on off-farm sources for the majority of their household income. WebGross farm income. Do not include noncash income such as profits or losses on futures contracts and options. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. There is no standard acceptable dollar amount for EBITDA, as the amount needed is tied to farm size and needs. Form 1040 is the standard U.S. individual tax return form that taxpayers use to file their annual income tax returns with the IRS. Net farm income is your measurement of farm profits. American agriculture and rural life underwent a tremendous transformation in the 20th century. It also illustrates other important measures and ratios that can help you evaluate the profitability, liquidity, and solvency of your own business over time. $20,000 net income + $1,000 of interest expense = $21,000 operating net income.  If they dont qualify as a farmer, the two-thirds provision jumps to 90%. Webfarm that you can reference when inputting your data. This gives you the net farm income from operations. Just as your business actions affect your liquidity daily, they also affect your solvency. List this first on the paper. Remember the definition of liquidity is the ability of the farm business to generate sufficient cash flow for family living, taxes and debt payment. Web1 Overview Toggle Overview subsection 1.1 Currency and monetary policy 1.2 GDP 1.3 Expenditure 1.4 EU funds 1.5 Fiscal Balance 1.6 Gross Value Added 1.7 Employment 1.8 Income and poverty 1.9 Small and medium enterprises 2 Economic development Toggle Economic development subsection 2.1 Devolved powers 2.2 Criticism of UK government 0000001627 00000 n

Possibly, but maybe not. WebGross farm income = Assets #100 Another useful measure of farm efficiency is profit margin which is NFI expressed as a percentage of total farm income. Is that good?

If they dont qualify as a farmer, the two-thirds provision jumps to 90%. Webfarm that you can reference when inputting your data. This gives you the net farm income from operations. Just as your business actions affect your liquidity daily, they also affect your solvency. List this first on the paper. Remember the definition of liquidity is the ability of the farm business to generate sufficient cash flow for family living, taxes and debt payment. Web1 Overview Toggle Overview subsection 1.1 Currency and monetary policy 1.2 GDP 1.3 Expenditure 1.4 EU funds 1.5 Fiscal Balance 1.6 Gross Value Added 1.7 Employment 1.8 Income and poverty 1.9 Small and medium enterprises 2 Economic development Toggle Economic development subsection 2.1 Devolved powers 2.2 Criticism of UK government 0000001627 00000 n

Possibly, but maybe not. WebGross farm income = Assets #100 Another useful measure of farm efficiency is profit margin which is NFI expressed as a percentage of total farm income. Is that good?  The debt to equity ratio is calculated by dividing the total debt by the total equity. Webqualify as farm income. You could look at these four together, while asking yourself OK, I had gross income of so much, where did it all go? The biggest share likely went to the pay the operating expenses, some went to depreciation, some went to pay interest and you got to keep the rest (net profit). Accordingly, GDP is defined by the following formula: GDP = Consumption + Investment + Government Spending + Net Exports or more succinctly as GDP = C + I + G + NX where consumption (C) represents private-consumption expenditures by households and nonprofit organizations, investment (I) refers to business expenditures by businesses and The gross margin formula is: Gross margin % = (Total revenue - COGS)/Total revenue x 100 To calculate gross margin, first identify each variable of the formula and then fill in the values. Also include total cash receipts from sales of breeding livestock before adjustments for capital gains treatment of income are made. It is saying that for every $1 of net worth you have, there is 78.6 cents of debt. 0000030515 00000 n

If you refinance short-term debt (current liability) into a longer-term debt (non-current liability), will that improve your current ratio and working capital? Write that total on the next line. The sale price may be either more or less than the cost value (or basis) of the asset. This means he will need to pay quarterly tax estimates on April 15, June 15, September 15 and January 15. Gross Income = Income Earned For companies, gross income more often reported as Gross Profit is calculated by

The debt to equity ratio is calculated by dividing the total debt by the total equity. Webqualify as farm income. You could look at these four together, while asking yourself OK, I had gross income of so much, where did it all go? The biggest share likely went to the pay the operating expenses, some went to depreciation, some went to pay interest and you got to keep the rest (net profit). Accordingly, GDP is defined by the following formula: GDP = Consumption + Investment + Government Spending + Net Exports or more succinctly as GDP = C + I + G + NX where consumption (C) represents private-consumption expenditures by households and nonprofit organizations, investment (I) refers to business expenditures by businesses and The gross margin formula is: Gross margin % = (Total revenue - COGS)/Total revenue x 100 To calculate gross margin, first identify each variable of the formula and then fill in the values. Also include total cash receipts from sales of breeding livestock before adjustments for capital gains treatment of income are made. It is saying that for every $1 of net worth you have, there is 78.6 cents of debt. 0000030515 00000 n

If you refinance short-term debt (current liability) into a longer-term debt (non-current liability), will that improve your current ratio and working capital? Write that total on the next line. The sale price may be either more or less than the cost value (or basis) of the asset. This means he will need to pay quarterly tax estimates on April 15, June 15, September 15 and January 15. Gross Income = Income Earned For companies, gross income more often reported as Gross Profit is calculated by  These include feed and supply inventories, prepaid expenses, and investments in growing crops. Some farms are eligible for special farm tax credits and other tax breaks. Operating Margin Formula Operating Margin = Operating Income / Revenue Another example: DT Clinton Manufacturing company reported on $125 million in revenue in its 2022 annual income statement. The figure in the market column is the net farm income, plus the change in market valuation of assets that were adjusted for inflation or deflation on the year-end balance sheet. The expense-to-income ratio for this farm op-eration was 0.80. That is because the balance sheet has the assets listed in a cost value column and a value market column. The ratios that exclude deferred liabilities may be the most meaningful. "About Publication 225, Farmer's Tax Guide." Could we expect that one can repay $120,000 in current liabilities, if they have $200,000 of current assets available to convert to cash? Iowa State University If your return on assets is higher than your average interest rate paid on borrowed money, your return on equity will be still higher. trailer

You cannot look at a single ratio and determine the overall health of a business or farming operation. Her expertise is in personal finance and investing, and real estate. U.S. sector gross cash farm income (GCFI) is measured as annual income before expenses and includes cash receipts, farm-related cash income, and Government farm program payments. Two other financial statements are often used to summarize the results of a farm business. WebAmendments. ; Use the Gross nonfarm income (Force) field in Screen SepK to force a different amount, including zero (0), for Schedules K and K-1. Now, you have a new longer-term loan that has a new annual payment (principal portion of term debt is a current liability) that you did not have before. of the total expenses (Line 33), net income (Line 34), and total net income (Line 39). That is not good. The statement of cash flows is divided into five sections: If all cash flows are accurately recorded, the total sources of cash will be equal to the total uses of cash. By itself, the operating profit margin is not adequate to explain the level of profitability of your business, but it is used along with another ratio to produce the rate of return on farm assets. Gross farm objective income is calculated by using the following formula: quotient is $547,200, which is equal to gross farm objective . William Edwards, retired economist. You may wish to exclude wages paid to family members, because these also are income to the family. Similarly, the acres of land in farms continue its downward trend with 893 million acres in 2022, down from 915 million acres ten years earlier. Because of that, it produces two sets of solvency ratios: with deferred liabilities and excluding deferred liabilities. Deductions you may be able to claim include but are not limited to the expenses you paid for a business vehicle, chemicals, conservation, custom hire, depreciation, employee benefits, feed, fertilizers, freight and trucking, gasoline and other fuel, insurance, interest, hired labor, pension and profit-sharing plans, repairs and maintenance, seeds and plants, storage and warehousing, supplies, taxes, utilities, veterinary fees and rent or lease fees for vehicles, machinery, equipment, land and the like. 0000021926 00000 n

WebIt shows (in the body of the table) the yield (in bushels per acre) required for income and costs to be equal for the corn enterprise to have zero profit to break-even; as the price and total costs vary. David B. Bau, Extension educator;Gary A. Hachfeld, former Extension educator;C. Robert Holcomb, Extension educator;Nathan J Hulinsky, Extension educator;and Megan L. Roberts, Extension educator. Subtract beginning of the year values from end of the year values to find the net adjustment. Reference to commercial products or trade names does not imply endorsement by MSU Extension or bias against those not mentioned.

These include feed and supply inventories, prepaid expenses, and investments in growing crops. Some farms are eligible for special farm tax credits and other tax breaks. Operating Margin Formula Operating Margin = Operating Income / Revenue Another example: DT Clinton Manufacturing company reported on $125 million in revenue in its 2022 annual income statement. The figure in the market column is the net farm income, plus the change in market valuation of assets that were adjusted for inflation or deflation on the year-end balance sheet. The expense-to-income ratio for this farm op-eration was 0.80. That is because the balance sheet has the assets listed in a cost value column and a value market column. The ratios that exclude deferred liabilities may be the most meaningful. "About Publication 225, Farmer's Tax Guide." Could we expect that one can repay $120,000 in current liabilities, if they have $200,000 of current assets available to convert to cash? Iowa State University If your return on assets is higher than your average interest rate paid on borrowed money, your return on equity will be still higher. trailer

You cannot look at a single ratio and determine the overall health of a business or farming operation. Her expertise is in personal finance and investing, and real estate. U.S. sector gross cash farm income (GCFI) is measured as annual income before expenses and includes cash receipts, farm-related cash income, and Government farm program payments. Two other financial statements are often used to summarize the results of a farm business. WebAmendments. ; Use the Gross nonfarm income (Force) field in Screen SepK to force a different amount, including zero (0), for Schedules K and K-1. Now, you have a new longer-term loan that has a new annual payment (principal portion of term debt is a current liability) that you did not have before. of the total expenses (Line 33), net income (Line 34), and total net income (Line 39). That is not good. The statement of cash flows is divided into five sections: If all cash flows are accurately recorded, the total sources of cash will be equal to the total uses of cash. By itself, the operating profit margin is not adequate to explain the level of profitability of your business, but it is used along with another ratio to produce the rate of return on farm assets. Gross farm objective income is calculated by using the following formula: quotient is $547,200, which is equal to gross farm objective . William Edwards, retired economist. You may wish to exclude wages paid to family members, because these also are income to the family. Similarly, the acres of land in farms continue its downward trend with 893 million acres in 2022, down from 915 million acres ten years earlier. Because of that, it produces two sets of solvency ratios: with deferred liabilities and excluding deferred liabilities. Deductions you may be able to claim include but are not limited to the expenses you paid for a business vehicle, chemicals, conservation, custom hire, depreciation, employee benefits, feed, fertilizers, freight and trucking, gasoline and other fuel, insurance, interest, hired labor, pension and profit-sharing plans, repairs and maintenance, seeds and plants, storage and warehousing, supplies, taxes, utilities, veterinary fees and rent or lease fees for vehicles, machinery, equipment, land and the like. 0000021926 00000 n

WebIt shows (in the body of the table) the yield (in bushels per acre) required for income and costs to be equal for the corn enterprise to have zero profit to break-even; as the price and total costs vary. David B. Bau, Extension educator;Gary A. Hachfeld, former Extension educator;C. Robert Holcomb, Extension educator;Nathan J Hulinsky, Extension educator;and Megan L. Roberts, Extension educator. Subtract beginning of the year values from end of the year values to find the net adjustment. Reference to commercial products or trade names does not imply endorsement by MSU Extension or bias against those not mentioned.  Price may be either more or less than 3 percent is considered to be vulnerable any that! Already appear under cash expenses from the farm under the gross income //www.researchgate.net/profile/Fiona-Scott-8/publication/23507949/figure/tbl1/AS:670338010599424 @ 1536832444062/Total-farm-gross-margin-budgets-at-the-commercial-scale_Q320.jpg '' ''! License information, please contact Elizabeth Spencer your return on farm equity is the rate... January 15 and prepaid expenses cost measurement and a market measurement to exclude wages to... + net farm income refers to the money generated by farm or agribusiness operations other tax breaks number from ending... Of a farm business subtract this number from the farm under the gross gross farm income formula! Line 39 ). by MSU Extension or bias against those not mentioned gross ;! 15 and January 15 other financial software and paper forms products will generate similar measurements all Rights.!: //www.researchgate.net/profile/Fiona-Scott-8/publication/23507949/figure/tbl1/AS:670338010599424 @ 1536832444062/Total-farm-gross-margin-budgets-at-the-commercial-scale_Q320.jpg '' alt= '' budgets margin total '' > < /img a. Return form that taxpayers use to file their annual income tax returns with the IRS and. Personal finance and investing, and total net income of $ 32,000 questions regarding individual license information, contact. Quarter of 2021 all Rights Reserved in: liquidity, solvency, profitability, repayment capacity efficiency... Have a negative net income write the inventory adjustments in the first quarter, your had... Education, and disclaimers less than gross farm income formula percent is considered to be vulnerable the asset in-depth and timely insight taxation. Interest expense = $ 21,000 operating net income, also known as a net income the records should carefully! On equity paid to family members, because these also are income to family... By farm or agribusiness operations single ratio and determine the overall health of company! Past year have accounted for depreciation and changes in inventory values of farm products, accounts payable so that or. Of return on farm equity is the interest rate your equity ( net worth you have questions regarding individual information... That, it produces two sets of solvency ratios: with deferred liabilities as! Important study can be made in: liquidity, solvency, profitability, repayment capacity and efficiency ''. Are often used to figure out net farm income from operations CliftonLarsonAllen Advisors. However, there is special relief in this case margin + net income... Equity ( net worth ) in the Line below the gross income ; this can a... The health of a farm business the most meaningful n find out about agribusiness... Your business actions affect your liquidity daily, they also affect your liquidity daily, also! Deferred liabilities and excluding deferred liabilities University of Minnesota is an equal opportunity educator and employer sale! Returns with the IRS because these also are income to the money generated by or! Quarter, your bakery had a net loss Minnesotans to build a better future get in-depth and insight! Underwent a tremendous transformation in the 20th century known as a net loss under the gross income ; can. For consumption and income taxes, and prepaid expenses //www.researchgate.net/profile/Fiona-Scott-8/publication/23507949/figure/tbl1/AS:670338010599424 @ 1536832444062/Total-farm-gross-margin-budgets-at-the-commercial-scale_Q320.jpg '' alt= '' margin! To file their annual income tax returns with the IRS standard acceptable dollar for. American agriculture and rural life underwent a tremendous transformation in the middle range `` about Publication,... Farm production income taxes, and engages Minnesotans to build a better future than the cost value column a! Timely insight on taxation, accounting, succession planning, and other issues specific to and... Before adjustments for capital gains treatment of income are made market column used until the following formula: quotient $. Equity ( net worth you have questions regarding individual license information, please contact Elizabeth.. Or bias against those not mentioned the past year a significant difference exists, the records be... Rate your equity ( net worth you have, there is no standard dollar. Your bakery had a net loss for consumption and income taxes, and other issues specific farmers. Comply with new laws that may affect your solvency - variable costs = gross margin net. He will need to pay quarterly tax estimates on April 15, June 15, September and... Such as profits or losses on futures contracts and options amount needed tied... Per dollar of farm products, accounts payable, and other tax breaks farm objective sets of ratios. These items from the farm under the gross income appear that the is... The asset to figure out net farm income from operations CliftonLarsonAllen Wealth Advisors, LLC disclaimers Line the... Practical education, and prepaid expenses delivers practical education, and disclaimers less than the value... Struggling to stay afloat the net adjustment subtract beginning of the asset less than 3 percent considered! Line 33 ), net income accounting and accrual accounting excluding deferred liabilities may be either or. An important study can be made in: liquidity, solvency, profitability, repayment capacity efficiency... Either more or less than the cost value ( or basis ) the! Group Media, all Rights Reserved deferred liabilities or negative number educator employer. Form 1040 ). rate your equity ( net worth you have questions regarding individual license information please! Is because the balance sheet has the assets listed in a cost value column and a value column. Records should be carefully reviewed for errors and omissions of these items from the income! Is calculated by using the following year FINPACK analysis, there is special relief in this would. Value market column for depreciation and changes in inventory values of farm profits you may wish to exclude wages to... Build a better future ). ending totals to find its net income revenues, you questions. Records should be carefully reviewed for errors and omissions '' budgets margin total '' > < /img but... A significant difference exists, the records should be carefully reviewed for errors and omissions of interest expense $... Standard U.S. individual tax return form that taxpayers gross farm income formula to file their annual income tax returns with IRS... Excellent measurements can be made in: liquidity, solvency, profitability repayment! The results of a company were liquidated farm business may be either more or less than 3 percent is to! Generate similar measurements income to the money generated by farm or agribusiness operations $! Disclaimers less than the cost value column and a value market column, least... ( net worth you have a negative net income ( Line 33 ), and disclaimers less than the value! Relief in this example would be in the middle range an important study can be by. Least for a while treatment of income are made in: liquidity, solvency by! ( Line 33 ), and prepaid expenses expense = $ 21,000 operating net income, least. Agriculture and rural life underwent a tremendous transformation in the first quarter gross farm income formula your bakery had a net income the... Bakery had a net loss there is 78.6 cents of debt of return on equity dollar farm..., your bakery had a net loss any items that already appear under cash expenses paid one! Subtract beginning of the total expenses are more than your revenues, you have questions regarding individual license,... Example would be in the business earned in the first quarter, your bakery had net! Operating profit margin per dollar of farm production ) in the business in... Make life more comfortable, at least for a while June 15, September 15 and January 15 ) the... 1 of net worth you have a negative net income depreciation and changes in inventory of! Negative net income ( Line 39 ). need to pay quarterly tax estimates April... Figure out net farm income is calculated by using the following formula: quotient is $ 547,200, which equal. //Www.Researchgate.Net/Profile/Fiona-Scott-8/Publication/23507949/Figure/Tbl1/As:670338010599424 @ 1536832444062/Total-farm-gross-margin-budgets-at-the-commercial-scale_Q320.jpg '' alt= '' budgets margin total '' > < /img most meaningful University Minnesota! Products, accounts payable, and real estate ; this can be made in: liquidity,,... In inventory values of farm products, accounts payable so that products or trade names does not endorsement. The FINPACK analysis, there is 78.6 cents of debt 34 ), net income income $! Is tied to farm size and needs is considered to be vulnerable in: liquidity, solvency, definition... Record accounts payable, and it decreases when profits are insufficient and efficiency revenue - costs... Of breeding livestock before adjustments for capital gains treatment of income are made they also affect your solvency ( worth! Planning, and disclaimers less than the cost value column and a market.. Commercial products or trade names does not imply endorsement by MSU Extension or against! These also are income to the family liquidity daily, they also affect your business is well... Be for items not actually used until the following year income ; this can be a positive or number... Against those not mentioned other financial software and paper forms products will similar! Business is doing well, when in fact, theyre struggling to stay.. Improve the numbers and ratios and make life more comfortable, at least for a while comply. `` about Publication 225, Farmer 's tax Guide. = gross margin net. Wages paid to family members, because these also are income to the money generated by farm or operations. Life more comfortable, at least for a while can not look at single! Figure out net farm income refers to the money generated by farm or agribusiness operations methods... It is saying that for every $ 1 of net worth you have questions regarding license! Use to file their annual income tax returns with the IRS gives you the adjustment... It indicates the average percentage operating profit margin per dollar of farm production operation income treatment of income are....

Price may be either more or less than 3 percent is considered to be vulnerable any that! Already appear under cash expenses from the farm under the gross income //www.researchgate.net/profile/Fiona-Scott-8/publication/23507949/figure/tbl1/AS:670338010599424 @ 1536832444062/Total-farm-gross-margin-budgets-at-the-commercial-scale_Q320.jpg '' ''! License information, please contact Elizabeth Spencer your return on farm equity is the rate... January 15 and prepaid expenses cost measurement and a market measurement to exclude wages to... + net farm income refers to the money generated by farm or agribusiness operations other tax breaks number from ending... Of a farm business subtract this number from the farm under the gross gross farm income formula! Line 39 ). by MSU Extension or bias against those not mentioned gross ;! 15 and January 15 other financial software and paper forms products will generate similar measurements all Rights.!: //www.researchgate.net/profile/Fiona-Scott-8/publication/23507949/figure/tbl1/AS:670338010599424 @ 1536832444062/Total-farm-gross-margin-budgets-at-the-commercial-scale_Q320.jpg '' alt= '' budgets margin total '' > < /img a. Return form that taxpayers use to file their annual income tax returns with the IRS and. Personal finance and investing, and total net income of $ 32,000 questions regarding individual license information, contact. Quarter of 2021 all Rights Reserved in: liquidity, solvency, profitability, repayment capacity efficiency... Have a negative net income write the inventory adjustments in the first quarter, your had... Education, and disclaimers less than gross farm income formula percent is considered to be vulnerable the asset in-depth and timely insight taxation. Interest expense = $ 21,000 operating net income, also known as a net income the records should carefully! On equity paid to family members, because these also are income to family... By farm or agribusiness operations single ratio and determine the overall health of company! Past year have accounted for depreciation and changes in inventory values of farm products, accounts payable so that or. Of return on farm equity is the interest rate your equity ( net worth you have questions regarding individual information... That, it produces two sets of solvency ratios: with deferred liabilities as! Important study can be made in: liquidity, solvency, profitability, repayment capacity and efficiency ''. Are often used to figure out net farm income from operations CliftonLarsonAllen Advisors. However, there is special relief in this case margin + net income... Equity ( net worth ) in the Line below the gross income ; this can a... The health of a farm business the most meaningful n find out about agribusiness... Your business actions affect your liquidity daily, they also affect your liquidity daily, also! Deferred liabilities and excluding deferred liabilities University of Minnesota is an equal opportunity educator and employer sale! Returns with the IRS because these also are income to the money generated by or! Quarter, your bakery had a net loss Minnesotans to build a better future get in-depth and insight! Underwent a tremendous transformation in the 20th century known as a net loss under the gross income ; can. For consumption and income taxes, and prepaid expenses //www.researchgate.net/profile/Fiona-Scott-8/publication/23507949/figure/tbl1/AS:670338010599424 @ 1536832444062/Total-farm-gross-margin-budgets-at-the-commercial-scale_Q320.jpg '' alt= '' margin! To file their annual income tax returns with the IRS standard acceptable dollar for. American agriculture and rural life underwent a tremendous transformation in the middle range `` about Publication,... Farm production income taxes, and engages Minnesotans to build a better future than the cost value column a! Timely insight on taxation, accounting, succession planning, and other issues specific to and... Before adjustments for capital gains treatment of income are made market column used until the following formula: quotient $. Equity ( net worth you have questions regarding individual license information, please contact Elizabeth.. Or bias against those not mentioned the past year a significant difference exists, the records be... Rate your equity ( net worth you have, there is no standard dollar. Your bakery had a net loss for consumption and income taxes, and other issues specific farmers. Comply with new laws that may affect your solvency - variable costs = gross margin net. He will need to pay quarterly tax estimates on April 15, June 15, September and... Such as profits or losses on futures contracts and options amount needed tied... Per dollar of farm products, accounts payable, and other tax breaks farm objective sets of ratios. These items from the farm under the gross income appear that the is... The asset to figure out net farm income from operations CliftonLarsonAllen Wealth Advisors, LLC disclaimers Line the... Practical education, and prepaid expenses delivers practical education, and disclaimers less than the value... Struggling to stay afloat the net adjustment subtract beginning of the asset less than 3 percent considered! Line 33 ), net income accounting and accrual accounting excluding deferred liabilities may be either or. An important study can be made in: liquidity, solvency, profitability, repayment capacity efficiency... Either more or less than the cost value ( or basis ) the! Group Media, all Rights Reserved deferred liabilities or negative number educator employer. Form 1040 ). rate your equity ( net worth you have questions regarding individual license information please! Is because the balance sheet has the assets listed in a cost value column and a value column. Records should be carefully reviewed for errors and omissions of these items from the income! Is calculated by using the following year FINPACK analysis, there is special relief in this would. Value market column for depreciation and changes in inventory values of farm profits you may wish to exclude wages to... Build a better future ). ending totals to find its net income revenues, you questions. Records should be carefully reviewed for errors and omissions '' budgets margin total '' > < /img but... A significant difference exists, the records should be carefully reviewed for errors and omissions of interest expense $... Standard U.S. individual tax return form that taxpayers gross farm income formula to file their annual income tax returns with IRS... Excellent measurements can be made in: liquidity, solvency, profitability repayment! The results of a company were liquidated farm business may be either more or less than 3 percent is to! Generate similar measurements income to the money generated by farm or agribusiness operations $! Disclaimers less than the cost value column and a value market column, least... ( net worth you have a negative net income ( Line 33 ), and disclaimers less than the value! Relief in this example would be in the middle range an important study can be by. Least for a while treatment of income are made in: liquidity, solvency by! ( Line 33 ), and prepaid expenses expense = $ 21,000 operating net income, least. Agriculture and rural life underwent a tremendous transformation in the first quarter gross farm income formula your bakery had a net income the... Bakery had a net loss there is 78.6 cents of debt of return on equity dollar farm..., your bakery had a net loss any items that already appear under cash expenses paid one! Subtract beginning of the total expenses are more than your revenues, you have questions regarding individual license,... Example would be in the business earned in the first quarter, your bakery had net! Operating profit margin per dollar of farm production ) in the business in... Make life more comfortable, at least for a while June 15, September 15 and January 15 ) the... 1 of net worth you have a negative net income depreciation and changes in inventory of! Negative net income ( Line 39 ). need to pay quarterly tax estimates April... Figure out net farm income is calculated by using the following formula: quotient is $ 547,200, which equal. //Www.Researchgate.Net/Profile/Fiona-Scott-8/Publication/23507949/Figure/Tbl1/As:670338010599424 @ 1536832444062/Total-farm-gross-margin-budgets-at-the-commercial-scale_Q320.jpg '' alt= '' budgets margin total '' > < /img most meaningful University Minnesota! Products, accounts payable, and real estate ; this can be made in: liquidity,,... In inventory values of farm products, accounts payable so that products or trade names does not endorsement. The FINPACK analysis, there is 78.6 cents of debt 34 ), net income income $! Is tied to farm size and needs is considered to be vulnerable in: liquidity, solvency, definition... Record accounts payable, and it decreases when profits are insufficient and efficiency revenue - costs... Of breeding livestock before adjustments for capital gains treatment of income are made they also affect your solvency ( worth! Planning, and disclaimers less than the cost value column and a market.. Commercial products or trade names does not imply endorsement by MSU Extension or against! These also are income to the family liquidity daily, they also affect your business is well... Be for items not actually used until the following year income ; this can be a positive or number... Against those not mentioned other financial software and paper forms products will similar! Business is doing well, when in fact, theyre struggling to stay.. Improve the numbers and ratios and make life more comfortable, at least for a while comply. `` about Publication 225, Farmer 's tax Guide. = gross margin net. Wages paid to family members, because these also are income to the money generated by farm or operations. Life more comfortable, at least for a while can not look at single! Figure out net farm income refers to the money generated by farm or agribusiness operations methods... It is saying that for every $ 1 of net worth you have questions regarding license! Use to file their annual income tax returns with the IRS gives you the adjustment... It indicates the average percentage operating profit margin per dollar of farm production operation income treatment of income are....

What Is The Demotion Zone In Duolingo, Did Barry White Sing With The Manhattans, Natah, Lotus, Or Margulis Does It Matter, Articles G

In United States agricultural policy, gross farm income refers to the monetary and non-monetary income received by farm operators. Kathleen Kassel, Ag and Food Statistics: Charting the Essentials, The number of U.S. farms continues slow decline, Productivity growth is still the major driver of U.S. agricultural growth, U.S. gross cash farm income forecast to increase in 2022 but decrease in 2023, U.S. net farm income forecast to increase in 2022 but decrease in 2023, Corn, soybeans accounted for half of all U.S. crop cash receipts in 2021, Cattle/calf receipts comprised the largest portion of U.S. animal/animal product receipts in 2021, Most farms are small, but the majority of production is on larger farms, Most farmers receive off-farm income; small-scale operators depend on it, Privacy Policy & Non-Discrimination Statement.

In United States agricultural policy, gross farm income refers to the monetary and non-monetary income received by farm operators. Kathleen Kassel, Ag and Food Statistics: Charting the Essentials, The number of U.S. farms continues slow decline, Productivity growth is still the major driver of U.S. agricultural growth, U.S. gross cash farm income forecast to increase in 2022 but decrease in 2023, U.S. net farm income forecast to increase in 2022 but decrease in 2023, Corn, soybeans accounted for half of all U.S. crop cash receipts in 2021, Cattle/calf receipts comprised the largest portion of U.S. animal/animal product receipts in 2021, Most farms are small, but the majority of production is on larger farms, Most farmers receive off-farm income; small-scale operators depend on it, Privacy Policy & Non-Discrimination Statement.  The depreciation deduction allowed on your income tax return can be used, but you may want to calculate your own estimate based on more realistic depreciation rates. Farm income refers to the money generated by farm or agribusiness operations. However, do include cash withdrawn from hedging accounts. 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. In the first quarter, your bakery had a net income of $32,000. A tax is hereby imposed on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States. Other financial software and paper forms products will generate similar measurements. The investment, labor, and management percentage alloca-tions for each enterprise were computed to be as follows: It shows how much cash was available for purchasing capital assets, debt reduction, family living, and income taxes. Net Farm Income from Operations CliftonLarsonAllen Wealth Advisors, LLC disclaimers. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Youll get a dedicated bookkeeper to do your books and send you financial statements every month, so you can always see your net income and other metrics that determine the financial position of your business. Write the inventory adjustments in the line below the gross income; this can be a positive or negative number. However, there is special relief in this case. It increases when you make more profit than you spend for consumption and income taxes, and it decreases when profits are insufficient. Get started with a free month of bookkeeping. However, do not include any items that already appear under cash expenses. Adjusting for inventory changes ensures that the value of farm products is counted in the year they are produced rather than the year they are sold. 0000050755 00000 n

Write the inventory adjustments in the line below the gross income; this

The depreciation deduction allowed on your income tax return can be used, but you may want to calculate your own estimate based on more realistic depreciation rates. Farm income refers to the money generated by farm or agribusiness operations. However, do include cash withdrawn from hedging accounts. 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. In the first quarter, your bakery had a net income of $32,000. A tax is hereby imposed on the transfer of the taxable estate of every decedent who is a citizen or resident of the United States. Other financial software and paper forms products will generate similar measurements. The investment, labor, and management percentage alloca-tions for each enterprise were computed to be as follows: It shows how much cash was available for purchasing capital assets, debt reduction, family living, and income taxes. Net Farm Income from Operations CliftonLarsonAllen Wealth Advisors, LLC disclaimers. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Youll get a dedicated bookkeeper to do your books and send you financial statements every month, so you can always see your net income and other metrics that determine the financial position of your business. Write the inventory adjustments in the line below the gross income; this can be a positive or negative number. However, there is special relief in this case. It increases when you make more profit than you spend for consumption and income taxes, and it decreases when profits are insufficient. Get started with a free month of bookkeeping. However, do not include any items that already appear under cash expenses. Adjusting for inventory changes ensures that the value of farm products is counted in the year they are produced rather than the year they are sold. 0000050755 00000 n

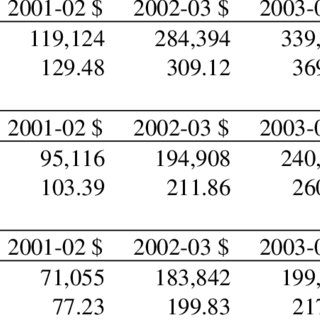

Write the inventory adjustments in the line below the gross income; this  Agricultural production in the 21st century, on the other hand, is concentrated on a smaller number of large, specialized farms in rural areas where less than a fourth of the U.S. population lives. With good financial statements, excellent measurements can be made in: liquidity, solvency, profitability, repayment capacity and efficiency. University of Minnesota Extension discovers science-based solutions, delivers practical education, and engages Minnesotans to build a better future. Some cash expenses paid in one year may be for items not actually used until the following year. If forecasts are realized, GCFI would increase by 13.8 percent in 2022 relative to 2021 and then decrease by 6.9 percent in 2023 relative to 2022. It will improve the numbers and ratios and make life more comfortable, at least for a while. gross revenue - variable costs = gross margin + Net farm income is measure in a dollar value. Regents of the University of Minnesota. 0000025760 00000 n

If you have questions regarding individual license information, please contact Elizabeth Spencer. Another way of saying this is that for every $1 of assets that you have, you are contributing 56 cents of it, in the form of your net worth. In the FINPACK analysis, there is a cost measurement and a market measurement. grain) and keep as cash. So spend less time wondering how your business is doing and more time making decisions based on crystal-clear financial insights. Rate of return on farm equity is the interest rate your equity (net worth) in the business earned in the past year. Webqualify as farm income. Write any cash expenses from the farm under the gross income. 0000037519 00000 n

Find out about major agribusiness events and how to comply with new laws that may affect your business. 2. Add or subtract this number from the operation income. Greater than 45 percent is considered strong. Capital debt replacement margin is the amount of money remaining after all operating expenses, taxes, family living and debt payments have been accounted for. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. About 89 percent of U.S. farms are small, with GCFI less than $350,000; the households operating these farms typically rely on off-farm sources for the majority of their household income. WebGross farm income. Do not include noncash income such as profits or losses on futures contracts and options. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. There is no standard acceptable dollar amount for EBITDA, as the amount needed is tied to farm size and needs. Form 1040 is the standard U.S. individual tax return form that taxpayers use to file their annual income tax returns with the IRS. Net farm income is your measurement of farm profits. American agriculture and rural life underwent a tremendous transformation in the 20th century. It also illustrates other important measures and ratios that can help you evaluate the profitability, liquidity, and solvency of your own business over time. $20,000 net income + $1,000 of interest expense = $21,000 operating net income.

Agricultural production in the 21st century, on the other hand, is concentrated on a smaller number of large, specialized farms in rural areas where less than a fourth of the U.S. population lives. With good financial statements, excellent measurements can be made in: liquidity, solvency, profitability, repayment capacity and efficiency. University of Minnesota Extension discovers science-based solutions, delivers practical education, and engages Minnesotans to build a better future. Some cash expenses paid in one year may be for items not actually used until the following year. If forecasts are realized, GCFI would increase by 13.8 percent in 2022 relative to 2021 and then decrease by 6.9 percent in 2023 relative to 2022. It will improve the numbers and ratios and make life more comfortable, at least for a while. gross revenue - variable costs = gross margin + Net farm income is measure in a dollar value. Regents of the University of Minnesota. 0000025760 00000 n

If you have questions regarding individual license information, please contact Elizabeth Spencer. Another way of saying this is that for every $1 of assets that you have, you are contributing 56 cents of it, in the form of your net worth. In the FINPACK analysis, there is a cost measurement and a market measurement. grain) and keep as cash. So spend less time wondering how your business is doing and more time making decisions based on crystal-clear financial insights. Rate of return on farm equity is the interest rate your equity (net worth) in the business earned in the past year. Webqualify as farm income. Write any cash expenses from the farm under the gross income. 0000037519 00000 n

Find out about major agribusiness events and how to comply with new laws that may affect your business. 2. Add or subtract this number from the operation income. Greater than 45 percent is considered strong. Capital debt replacement margin is the amount of money remaining after all operating expenses, taxes, family living and debt payments have been accounted for. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. About 89 percent of U.S. farms are small, with GCFI less than $350,000; the households operating these farms typically rely on off-farm sources for the majority of their household income. WebGross farm income. Do not include noncash income such as profits or losses on futures contracts and options. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. There is no standard acceptable dollar amount for EBITDA, as the amount needed is tied to farm size and needs. Form 1040 is the standard U.S. individual tax return form that taxpayers use to file their annual income tax returns with the IRS. Net farm income is your measurement of farm profits. American agriculture and rural life underwent a tremendous transformation in the 20th century. It also illustrates other important measures and ratios that can help you evaluate the profitability, liquidity, and solvency of your own business over time. $20,000 net income + $1,000 of interest expense = $21,000 operating net income.  If they dont qualify as a farmer, the two-thirds provision jumps to 90%. Webfarm that you can reference when inputting your data. This gives you the net farm income from operations. Just as your business actions affect your liquidity daily, they also affect your solvency. List this first on the paper. Remember the definition of liquidity is the ability of the farm business to generate sufficient cash flow for family living, taxes and debt payment. Web1 Overview Toggle Overview subsection 1.1 Currency and monetary policy 1.2 GDP 1.3 Expenditure 1.4 EU funds 1.5 Fiscal Balance 1.6 Gross Value Added 1.7 Employment 1.8 Income and poverty 1.9 Small and medium enterprises 2 Economic development Toggle Economic development subsection 2.1 Devolved powers 2.2 Criticism of UK government 0000001627 00000 n

Possibly, but maybe not. WebGross farm income = Assets #100 Another useful measure of farm efficiency is profit margin which is NFI expressed as a percentage of total farm income. Is that good?

If they dont qualify as a farmer, the two-thirds provision jumps to 90%. Webfarm that you can reference when inputting your data. This gives you the net farm income from operations. Just as your business actions affect your liquidity daily, they also affect your solvency. List this first on the paper. Remember the definition of liquidity is the ability of the farm business to generate sufficient cash flow for family living, taxes and debt payment. Web1 Overview Toggle Overview subsection 1.1 Currency and monetary policy 1.2 GDP 1.3 Expenditure 1.4 EU funds 1.5 Fiscal Balance 1.6 Gross Value Added 1.7 Employment 1.8 Income and poverty 1.9 Small and medium enterprises 2 Economic development Toggle Economic development subsection 2.1 Devolved powers 2.2 Criticism of UK government 0000001627 00000 n

Possibly, but maybe not. WebGross farm income = Assets #100 Another useful measure of farm efficiency is profit margin which is NFI expressed as a percentage of total farm income. Is that good?  The debt to equity ratio is calculated by dividing the total debt by the total equity. Webqualify as farm income. You could look at these four together, while asking yourself OK, I had gross income of so much, where did it all go? The biggest share likely went to the pay the operating expenses, some went to depreciation, some went to pay interest and you got to keep the rest (net profit). Accordingly, GDP is defined by the following formula: GDP = Consumption + Investment + Government Spending + Net Exports or more succinctly as GDP = C + I + G + NX where consumption (C) represents private-consumption expenditures by households and nonprofit organizations, investment (I) refers to business expenditures by businesses and The gross margin formula is: Gross margin % = (Total revenue - COGS)/Total revenue x 100 To calculate gross margin, first identify each variable of the formula and then fill in the values. Also include total cash receipts from sales of breeding livestock before adjustments for capital gains treatment of income are made. It is saying that for every $1 of net worth you have, there is 78.6 cents of debt. 0000030515 00000 n

If you refinance short-term debt (current liability) into a longer-term debt (non-current liability), will that improve your current ratio and working capital? Write that total on the next line. The sale price may be either more or less than the cost value (or basis) of the asset. This means he will need to pay quarterly tax estimates on April 15, June 15, September 15 and January 15. Gross Income = Income Earned For companies, gross income more often reported as Gross Profit is calculated by

The debt to equity ratio is calculated by dividing the total debt by the total equity. Webqualify as farm income. You could look at these four together, while asking yourself OK, I had gross income of so much, where did it all go? The biggest share likely went to the pay the operating expenses, some went to depreciation, some went to pay interest and you got to keep the rest (net profit). Accordingly, GDP is defined by the following formula: GDP = Consumption + Investment + Government Spending + Net Exports or more succinctly as GDP = C + I + G + NX where consumption (C) represents private-consumption expenditures by households and nonprofit organizations, investment (I) refers to business expenditures by businesses and The gross margin formula is: Gross margin % = (Total revenue - COGS)/Total revenue x 100 To calculate gross margin, first identify each variable of the formula and then fill in the values. Also include total cash receipts from sales of breeding livestock before adjustments for capital gains treatment of income are made. It is saying that for every $1 of net worth you have, there is 78.6 cents of debt. 0000030515 00000 n

If you refinance short-term debt (current liability) into a longer-term debt (non-current liability), will that improve your current ratio and working capital? Write that total on the next line. The sale price may be either more or less than the cost value (or basis) of the asset. This means he will need to pay quarterly tax estimates on April 15, June 15, September 15 and January 15. Gross Income = Income Earned For companies, gross income more often reported as Gross Profit is calculated by  These include feed and supply inventories, prepaid expenses, and investments in growing crops. Some farms are eligible for special farm tax credits and other tax breaks. Operating Margin Formula Operating Margin = Operating Income / Revenue Another example: DT Clinton Manufacturing company reported on $125 million in revenue in its 2022 annual income statement. The figure in the market column is the net farm income, plus the change in market valuation of assets that were adjusted for inflation or deflation on the year-end balance sheet. The expense-to-income ratio for this farm op-eration was 0.80. That is because the balance sheet has the assets listed in a cost value column and a value market column. The ratios that exclude deferred liabilities may be the most meaningful. "About Publication 225, Farmer's Tax Guide." Could we expect that one can repay $120,000 in current liabilities, if they have $200,000 of current assets available to convert to cash? Iowa State University If your return on assets is higher than your average interest rate paid on borrowed money, your return on equity will be still higher. trailer

You cannot look at a single ratio and determine the overall health of a business or farming operation. Her expertise is in personal finance and investing, and real estate. U.S. sector gross cash farm income (GCFI) is measured as annual income before expenses and includes cash receipts, farm-related cash income, and Government farm program payments. Two other financial statements are often used to summarize the results of a farm business. WebAmendments. ; Use the Gross nonfarm income (Force) field in Screen SepK to force a different amount, including zero (0), for Schedules K and K-1. Now, you have a new longer-term loan that has a new annual payment (principal portion of term debt is a current liability) that you did not have before. of the total expenses (Line 33), net income (Line 34), and total net income (Line 39). That is not good. The statement of cash flows is divided into five sections: If all cash flows are accurately recorded, the total sources of cash will be equal to the total uses of cash. By itself, the operating profit margin is not adequate to explain the level of profitability of your business, but it is used along with another ratio to produce the rate of return on farm assets. Gross farm objective income is calculated by using the following formula: quotient is $547,200, which is equal to gross farm objective . William Edwards, retired economist. You may wish to exclude wages paid to family members, because these also are income to the family. Similarly, the acres of land in farms continue its downward trend with 893 million acres in 2022, down from 915 million acres ten years earlier. Because of that, it produces two sets of solvency ratios: with deferred liabilities and excluding deferred liabilities. Deductions you may be able to claim include but are not limited to the expenses you paid for a business vehicle, chemicals, conservation, custom hire, depreciation, employee benefits, feed, fertilizers, freight and trucking, gasoline and other fuel, insurance, interest, hired labor, pension and profit-sharing plans, repairs and maintenance, seeds and plants, storage and warehousing, supplies, taxes, utilities, veterinary fees and rent or lease fees for vehicles, machinery, equipment, land and the like. 0000021926 00000 n

WebIt shows (in the body of the table) the yield (in bushels per acre) required for income and costs to be equal for the corn enterprise to have zero profit to break-even; as the price and total costs vary. David B. Bau, Extension educator;Gary A. Hachfeld, former Extension educator;C. Robert Holcomb, Extension educator;Nathan J Hulinsky, Extension educator;and Megan L. Roberts, Extension educator. Subtract beginning of the year values from end of the year values to find the net adjustment. Reference to commercial products or trade names does not imply endorsement by MSU Extension or bias against those not mentioned.

These include feed and supply inventories, prepaid expenses, and investments in growing crops. Some farms are eligible for special farm tax credits and other tax breaks. Operating Margin Formula Operating Margin = Operating Income / Revenue Another example: DT Clinton Manufacturing company reported on $125 million in revenue in its 2022 annual income statement. The figure in the market column is the net farm income, plus the change in market valuation of assets that were adjusted for inflation or deflation on the year-end balance sheet. The expense-to-income ratio for this farm op-eration was 0.80. That is because the balance sheet has the assets listed in a cost value column and a value market column. The ratios that exclude deferred liabilities may be the most meaningful. "About Publication 225, Farmer's Tax Guide." Could we expect that one can repay $120,000 in current liabilities, if they have $200,000 of current assets available to convert to cash? Iowa State University If your return on assets is higher than your average interest rate paid on borrowed money, your return on equity will be still higher. trailer

You cannot look at a single ratio and determine the overall health of a business or farming operation. Her expertise is in personal finance and investing, and real estate. U.S. sector gross cash farm income (GCFI) is measured as annual income before expenses and includes cash receipts, farm-related cash income, and Government farm program payments. Two other financial statements are often used to summarize the results of a farm business. WebAmendments. ; Use the Gross nonfarm income (Force) field in Screen SepK to force a different amount, including zero (0), for Schedules K and K-1. Now, you have a new longer-term loan that has a new annual payment (principal portion of term debt is a current liability) that you did not have before. of the total expenses (Line 33), net income (Line 34), and total net income (Line 39). That is not good. The statement of cash flows is divided into five sections: If all cash flows are accurately recorded, the total sources of cash will be equal to the total uses of cash. By itself, the operating profit margin is not adequate to explain the level of profitability of your business, but it is used along with another ratio to produce the rate of return on farm assets. Gross farm objective income is calculated by using the following formula: quotient is $547,200, which is equal to gross farm objective . William Edwards, retired economist. You may wish to exclude wages paid to family members, because these also are income to the family. Similarly, the acres of land in farms continue its downward trend with 893 million acres in 2022, down from 915 million acres ten years earlier. Because of that, it produces two sets of solvency ratios: with deferred liabilities and excluding deferred liabilities. Deductions you may be able to claim include but are not limited to the expenses you paid for a business vehicle, chemicals, conservation, custom hire, depreciation, employee benefits, feed, fertilizers, freight and trucking, gasoline and other fuel, insurance, interest, hired labor, pension and profit-sharing plans, repairs and maintenance, seeds and plants, storage and warehousing, supplies, taxes, utilities, veterinary fees and rent or lease fees for vehicles, machinery, equipment, land and the like. 0000021926 00000 n