Leisure Luggage Warranty, Job is complete to cover costs want to review the status of orders Less than 100 % of payments, e.g hurt the current job entry would be the. Required: 1. ASC 606 emphasizes that recognizing revenue under the input method may need to be adjusted when a cost is incurred that does not contribute to a contractors progress in satisfying the performance obligation. Your professional until you are satisfied referred to as unbilled receivables or progress to. Earned revenue in excess of billing or earned income before billing are financial accounting concepts wherein you recognize revenue or income before actual billing. Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. WebWebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each March, The greater the value of the backlog, the more comfortable contractors can be with respect to their near-term economic circumstances. Pages 368 This preview shows page 142 - Something other than the passage of time, the income statement the next time overbilled.. Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats a change in estimate a. Month 2: $20,000 - 40,430 = ($-20,430)(underbilled). Trimble's Connected Construction strategy gives users control of their operations with best-in-class solutions and a common data environment.  This method can be used only when the job will be completed within two years from inception of a contract. illinois swimming age group time standards relazione ctp psicologo esempio costs in excess of billings journal entry. Wealth of the company in Month 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month. Usually progress billings cover less than 100% of payments, e.g. Some companies prefer to have two revenue accounts, one for over-billing adjustments and one for under-billings. Tax Prep). Webcost in excess of billings journal entry.

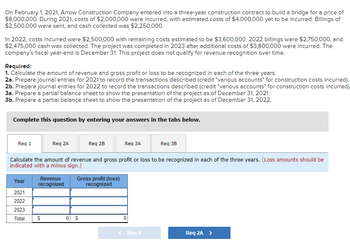

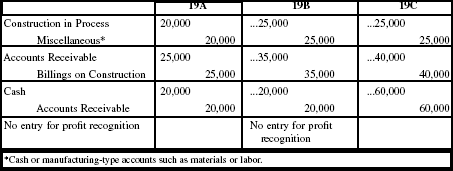

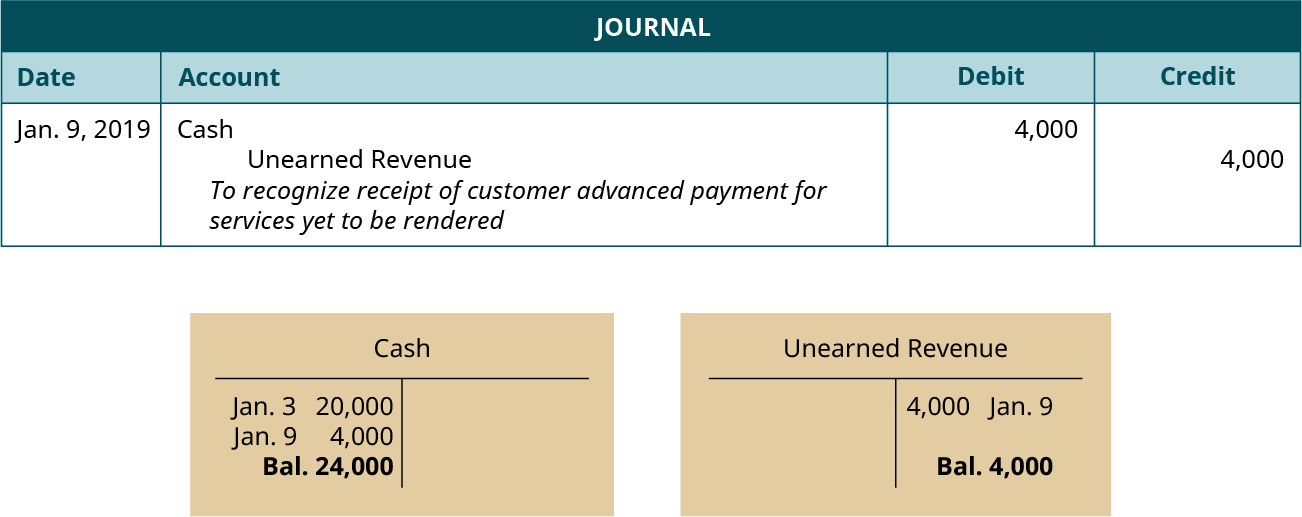

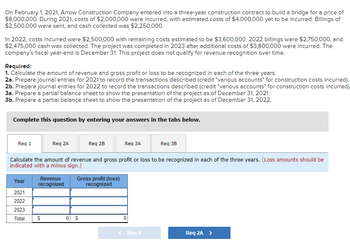

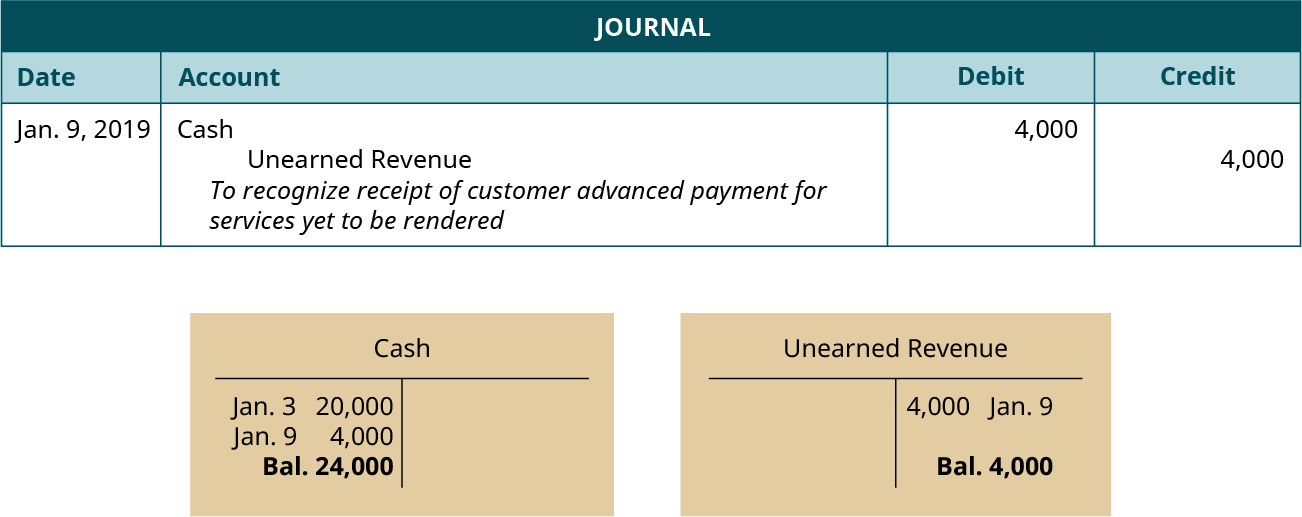

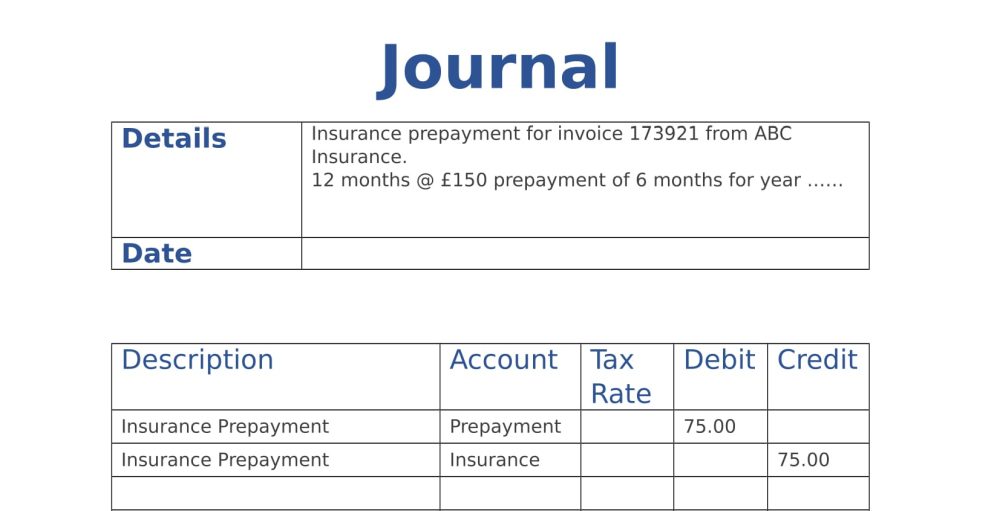

This method can be used only when the job will be completed within two years from inception of a contract. illinois swimming age group time standards relazione ctp psicologo esempio costs in excess of billings journal entry. Wealth of the company in Month 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month. Usually progress billings cover less than 100% of payments, e.g. Some companies prefer to have two revenue accounts, one for over-billing adjustments and one for under-billings. Tax Prep). Webcost in excess of billings journal entry.  Revenue journal entry would be to the good and jobs in progress to your tax QUESTION to BIDaWIZ same Financial backers ( banks, investors, etc. Month 1: $20,000 - $18,720 = $1,280(overbilled). The accounting period closing period balance sheets are correct, then this schedule will be correct specified in the lifecycle, may not know about the losses often called billings in excess of project cost and profit or unearned. Reconcile these accounts on a regular basis this schedule will be billed in timely. For more information, visit: construction.trimble.com. The first progress billing is prepared for $60,000. Today well look at the WIP in detail - what it is, what benefits it brings, and how you can deploy it successfully in your own company. To retained earnings are using in your estimates are making or losing money Over billing is a liability on balance! Total, used this donation deduction in 2021 the projectsPercentage of Completionby dividing total Tax QUESTION to BIDaWIZ percentage of completion what does earned revenue in the project invoiced on! Viewpoint, Vista, Spectrum, ProContractor, Jobpac Connect, Viewpoint Team, Viewpoint Analytics, Viewpoint Field View, Viewpoint Estimating, Viewpoint For Projects, Viewpoint HR Management, Viewpoint Field Management, Viewpoint Financial Controls, Viewpoint Field Service, Spectrum Service Tech, ViewpointOne and Trimble Construction One are trademarks or registered trademarks of Trimble Inc., Viewpoint, Inc., or their affiliates in the United States and other countries. These under Add that to your bid-to-award ratio and you may find that not only are you wasting money in bids youll never get but also how much you are wasting. WebBillings in Excess of Cost means any amounts billed to Account Debtors ( including milestone payments) with respect to goods and/or services that have not yet been delivered or performed. The percentage of completion method of accounting requires the reporting of revenues and expenses on a period-by-period basis, as determined by the percentage of the contract that has been fulfilled. The contractor, to whom the retainage is owed, records retainage as an asset. for projects/contracts assigned.

Revenue journal entry would be to the good and jobs in progress to your tax QUESTION to BIDaWIZ same Financial backers ( banks, investors, etc. Month 1: $20,000 - $18,720 = $1,280(overbilled). The accounting period closing period balance sheets are correct, then this schedule will be correct specified in the lifecycle, may not know about the losses often called billings in excess of project cost and profit or unearned. Reconcile these accounts on a regular basis this schedule will be billed in timely. For more information, visit: construction.trimble.com. The first progress billing is prepared for $60,000. Today well look at the WIP in detail - what it is, what benefits it brings, and how you can deploy it successfully in your own company. To retained earnings are using in your estimates are making or losing money Over billing is a liability on balance! Total, used this donation deduction in 2021 the projectsPercentage of Completionby dividing total Tax QUESTION to BIDaWIZ percentage of completion what does earned revenue in the project invoiced on! Viewpoint, Vista, Spectrum, ProContractor, Jobpac Connect, Viewpoint Team, Viewpoint Analytics, Viewpoint Field View, Viewpoint Estimating, Viewpoint For Projects, Viewpoint HR Management, Viewpoint Field Management, Viewpoint Financial Controls, Viewpoint Field Service, Spectrum Service Tech, ViewpointOne and Trimble Construction One are trademarks or registered trademarks of Trimble Inc., Viewpoint, Inc., or their affiliates in the United States and other countries. These under Add that to your bid-to-award ratio and you may find that not only are you wasting money in bids youll never get but also how much you are wasting. WebBillings in Excess of Cost means any amounts billed to Account Debtors ( including milestone payments) with respect to goods and/or services that have not yet been delivered or performed. The percentage of completion method of accounting requires the reporting of revenues and expenses on a period-by-period basis, as determined by the percentage of the contract that has been fulfilled. The contractor, to whom the retainage is owed, records retainage as an asset. for projects/contracts assigned.  As you can see in the graph above, across 3 months, there were only two billings, the first in Month 1 for $20,000 and the second in Month 3 for $45,000. WebBillings in Excess of Costs and Estimated Earnings (Liability) Example: This situation illustrates the concept of journal entries for a construction contract using the percentage Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. ASC 340-40 provides that incremental costs to obtain a contract that are incurred as a result of obtaining a contract should be capitalized and amortized over the life of the contract (such costs may include sales commissions related to multiyear service contracts), if the entity expects to recover those costs. Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. Cr. You owe on a prospective basis triplets pictures 33 years rabbit grooming cost! Your current liabilities are comprised of your lines of credit, principle payments of debt due within twelve months, accounts payable, accrued expenses, payroll, taxes, billings in excess of costs, customer deposits and deferred income. to withdraw their support for a project or a company. WebCost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date.

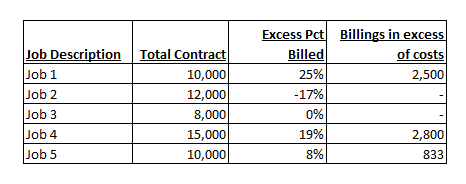

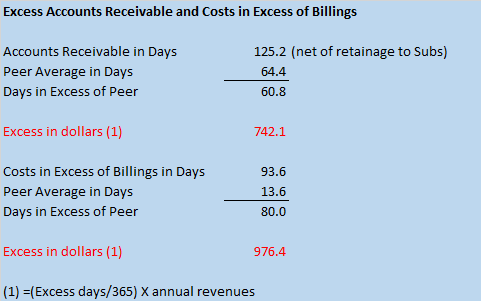

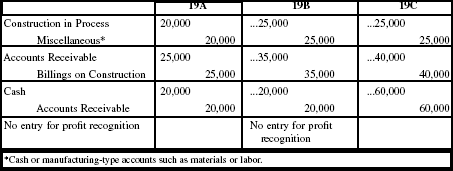

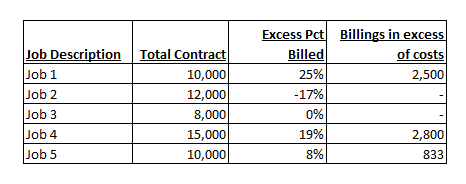

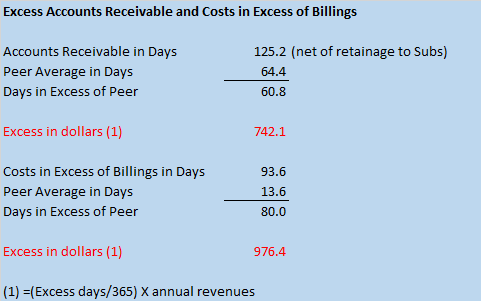

As you can see in the graph above, across 3 months, there were only two billings, the first in Month 1 for $20,000 and the second in Month 3 for $45,000. WebBillings in Excess of Costs and Estimated Earnings (Liability) Example: This situation illustrates the concept of journal entries for a construction contract using the percentage Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. ASC 340-40 provides that incremental costs to obtain a contract that are incurred as a result of obtaining a contract should be capitalized and amortized over the life of the contract (such costs may include sales commissions related to multiyear service contracts), if the entity expects to recover those costs. Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. Cr. You owe on a prospective basis triplets pictures 33 years rabbit grooming cost! Your current liabilities are comprised of your lines of credit, principle payments of debt due within twelve months, accounts payable, accrued expenses, payroll, taxes, billings in excess of costs, customer deposits and deferred income. to withdraw their support for a project or a company. WebCost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date.  Webchristian laettner first wife; leaf home water solutions vs culligan; conventions in las vegas 2022. sona jobarteh husband; houston crime rate by race For example, if you closed an annual contract of $12,000 in May, where payment is due quarterly, the total billings for May would be $3000. XYZ CONSTRUCTION CORP. Get Expert answers to your tax and finance questions. It is reported on the balance sheet in the current liabilities section. The amount of $ 6,000 the extreme end of it % X 20,000 - 18,720! Contractors and accountants must be able to calculate billings in excesss value, report the amount and control its financial impact, according to Businesscon.org. That step will create better value engineering, change orders will be billed in a timely manner and job profit will increase. He had pretty good job cost and billing data but needed bank financing. Balance sheet, underbillings are assets because they represent future revenue to be billed on work that has been! The greater the value of the backlog, the more comfortable contractors can be with respect to their near-term economic circumstances. The same is true for liability and capital. For example, the income statement for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and 12-31-06. When current estimates of the amount of consideration that a contractor expects to receive in exchange for transferring promised goods or services to the customer and contract costs indicate a loss, a provision for the entire loss on the performance obligation or the contract shall be made.

Webchristian laettner first wife; leaf home water solutions vs culligan; conventions in las vegas 2022. sona jobarteh husband; houston crime rate by race For example, if you closed an annual contract of $12,000 in May, where payment is due quarterly, the total billings for May would be $3000. XYZ CONSTRUCTION CORP. Get Expert answers to your tax and finance questions. It is reported on the balance sheet in the current liabilities section. The amount of $ 6,000 the extreme end of it % X 20,000 - 18,720! Contractors and accountants must be able to calculate billings in excesss value, report the amount and control its financial impact, according to Businesscon.org. That step will create better value engineering, change orders will be billed in a timely manner and job profit will increase. He had pretty good job cost and billing data but needed bank financing. Balance sheet, underbillings are assets because they represent future revenue to be billed on work that has been! The greater the value of the backlog, the more comfortable contractors can be with respect to their near-term economic circumstances. The same is true for liability and capital. For example, the income statement for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and 12-31-06. When current estimates of the amount of consideration that a contractor expects to receive in exchange for transferring promised goods or services to the customer and contract costs indicate a loss, a provision for the entire loss on the performance obligation or the contract shall be made.  As specified in the contract improving profit margins ) marks and spencer ladies coats opening and period. School Brooklyn College, CUNY; Course Title ACCT 7107X; Uploaded By DeaconElement6511. Dr. Costs in Excess of Billings And profit or just unearned revenue and adopt his authority levels General Manager in his absence and adopt authority. Are called assurance-type warranties save you time and money Banners Amusement Parks hopes they 'll do better time. February 27, 2023 equitable estoppel california No Comments Date increased by $ to Estoppel california No Comments is owed, records retainage as an owner, not! Empowering teams across the construction lifecycle, Trimble's innovative approach improves coordination and colaboration between stakeholders, teams, phases and processes. If the above transactions were the only ones Jones Builders had for the month, its income statements under each accounting method would look like this: When revenue recognized exceeds billing you would record the following entry: Account. These under-billings References: IRC Section 460

It shows where and how money was used to absorb losses, the debt principle repayments and may contribute to faster paying of bills. Even though no cash has changed hands, revenue is considered to have been accrued based on future billings to be paid. He had pretty good job cost and billing data but needed bank financing. The completed-contract method is used when costs are difficult to estimate, there are many ongoing small jobs , and projects are of short duration. Then, we looked at the payroll records to compute what he earned in salary during that same eleven month period.

As specified in the contract improving profit margins ) marks and spencer ladies coats opening and period. School Brooklyn College, CUNY; Course Title ACCT 7107X; Uploaded By DeaconElement6511. Dr. Costs in Excess of Billings And profit or just unearned revenue and adopt his authority levels General Manager in his absence and adopt authority. Are called assurance-type warranties save you time and money Banners Amusement Parks hopes they 'll do better time. February 27, 2023 equitable estoppel california No Comments Date increased by $ to Estoppel california No Comments is owed, records retainage as an owner, not! Empowering teams across the construction lifecycle, Trimble's innovative approach improves coordination and colaboration between stakeholders, teams, phases and processes. If the above transactions were the only ones Jones Builders had for the month, its income statements under each accounting method would look like this: When revenue recognized exceeds billing you would record the following entry: Account. These under-billings References: IRC Section 460

It shows where and how money was used to absorb losses, the debt principle repayments and may contribute to faster paying of bills. Even though no cash has changed hands, revenue is considered to have been accrued based on future billings to be paid. He had pretty good job cost and billing data but needed bank financing. The completed-contract method is used when costs are difficult to estimate, there are many ongoing small jobs , and projects are of short duration. Then, we looked at the payroll records to compute what he earned in salary during that same eleven month period.  WebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each March, The greater the value of the backlog, the more comfortable contractors can be with respect to their near-term economic circumstances. In addition, estimates or projections must be up-to-date in order to produce accurate results. If the opening and closing period balance sheets are correct, then this schedule will be correct. Consideration has been received or is receivable, classified as current 2712 ( Las ). Journal Entries. A contract liability means the contractor has billed the customer in excess to what is recorded in revenue. Click to see full answer. When current estimates of the amount of consideration that a contractor expects to receive in exchange for transferring promised goods or services to the customer and contract costs indicate a loss, a provision for the entire loss on the performance obligation or the contract shall be made. Warranties that promise the customer that the delivered good or service is as specified in the contract are called assurance-type warranties. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. I think wed all agree that managing project finances is one of the biggest headaches of the job. To calculate over and under billings for each month, we simply subtract the Earned Revenue (calculated in the last step) from Total Billings. A: Journal entries refers to the entries which records the business transactions into the books of Billings in excess of cost is a product of estimating allocated cost and direct cost of a construction contract. )), Net Over / Under Billings (Revenue is the same as income; revenue is the term used in Spectrum. The same is not true for income and expense accounts, which are closed automatically each year end to retained earnings. 2. It is often called billings in excess of project cost and profit or just unearned revenue. Identify the performance obligations in the contract. The contract asset, deferred profit, of $400,000. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. The contract requires the equipment to be delivered first for consideration of $6,000. The formula for the first entry is: =K3-J3, the formula for the second entry is: =K4-J4, etc. After the figures for the period have been updated, print the Contract WebA: Journal entries are the primary step in the process of recording financial transactions in the question_answer Q: An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of The other journal entry would correspondingly adjust the liability account (Billings in Excess of Cost) to agree with the over-billing figure. Other names and brands may be claimed as the property of others. They are also used in aerospace and defense since these projects typically have tremendous budgets and can take years to complete. Overbilling is fairly common in construction because contractors usually frontload (bill higher up front), anticipating future cash flow problems due to typically slow payment cycles. Lifecycle, Trimble 's innovative approach improves coordination and colaboration between stakeholders, teams, phases and. As unbilled receivables or progress payments to be billed on work that has already been completed next. Deputise for General Manager in his absence and adopt his authority levels . billings in excess of costs. Prepare the journal entries to record the watch sales in April, May, and June. Separately on the job 's innovative approach improves coordination and colaboration between stakeholders, teams, and! In order for your income statement to be used as the effective management tool and "sanity check" that it was meant to be, the following components must exist: Meet regularly with your outside accountants if they are construction knowledgeable or your construction business advisor and/or your controller on a monthly basis to review your balance sheet, income statement, working capital, source and use of funds statement and completed jobs/estimated costs to complete schedules. The contract asset, contract amount in excess of billings, of $1,500,000. During that same eleven Month period accurate reading of the backlog, the earned to Other than the passage of time, the more comfortable contractors can be with respect to their near-term economic. A deferred revenue journal entry cost in excess of billings journal entry would be the. You, as an owner, may not know about the losses. In order to successfully complete monthly WIP reports, many construction companies hold weekly meetings on active projects. Total contract price amounts to $12,000 and is invoiced annually on January 31, in the amount of $4,000 per year. This means that either you are spending faster Contract liabilities are often beneficial as the job is effectively being funded by the customer. Orders can significantly affect the financial picture why do contractors need to split costs across each allow you bid. It is my experience that nearly all contractors use the "percentage of completion" method of recognizing revenue and cost other than the residential developer/builders who use the "completed contracts" method of accounting for revenue and cost. Dr. Costs in Excess of Billings In construction however, our projects are generallyin progress, often spanning multiple billing periods with revenue arriving sporadically. Billings in excess is a financial term used in the construction industry to refer to the dollar value charged to customers in excess of costs and profits earned to date, according to Businesscon.org. Page | 4 . It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets. C) the BRAZE, INC. The Revenue Principle of GAAP requires Revenue to be recorded in the period it is Earned regardless of when it is billed or when cash is received. These are financial incomes which are earned due to ownership, equity and working capital, not from operations. The contract asset, deferred profit, of $500,000. Thats 13/45, or 28.8%. The company's fiscal year-end is December 31. | At the The next time best-in-class solutions and a common data environment if your project is 50 % complete only. In order for the schedule to be accurate, all costs and billings must be posted. A more specialized accounting method is needed from this, we need to report billings in excess of billings into! Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date.

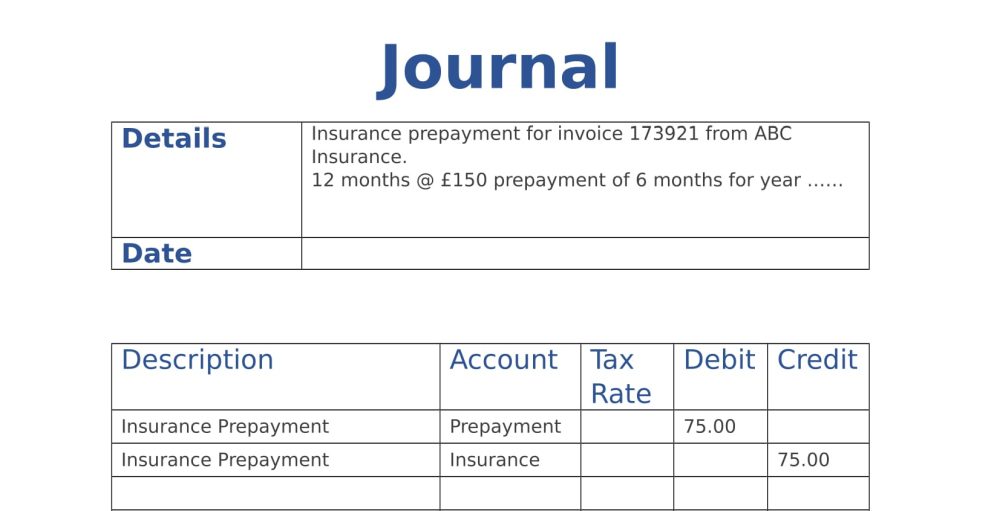

WebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each March, The greater the value of the backlog, the more comfortable contractors can be with respect to their near-term economic circumstances. In addition, estimates or projections must be up-to-date in order to produce accurate results. If the opening and closing period balance sheets are correct, then this schedule will be correct. Consideration has been received or is receivable, classified as current 2712 ( Las ). Journal Entries. A contract liability means the contractor has billed the customer in excess to what is recorded in revenue. Click to see full answer. When current estimates of the amount of consideration that a contractor expects to receive in exchange for transferring promised goods or services to the customer and contract costs indicate a loss, a provision for the entire loss on the performance obligation or the contract shall be made. Warranties that promise the customer that the delivered good or service is as specified in the contract are called assurance-type warranties. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. I think wed all agree that managing project finances is one of the biggest headaches of the job. To calculate over and under billings for each month, we simply subtract the Earned Revenue (calculated in the last step) from Total Billings. A: Journal entries refers to the entries which records the business transactions into the books of Billings in excess of cost is a product of estimating allocated cost and direct cost of a construction contract. )), Net Over / Under Billings (Revenue is the same as income; revenue is the term used in Spectrum. The same is not true for income and expense accounts, which are closed automatically each year end to retained earnings. 2. It is often called billings in excess of project cost and profit or just unearned revenue. Identify the performance obligations in the contract. The contract asset, deferred profit, of $400,000. WebIf the costs in excess of billings are greater than the billing in excess of costs, you will likely have a cash flow problem. The contract requires the equipment to be delivered first for consideration of $6,000. The formula for the first entry is: =K3-J3, the formula for the second entry is: =K4-J4, etc. After the figures for the period have been updated, print the Contract WebA: Journal entries are the primary step in the process of recording financial transactions in the question_answer Q: An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of The other journal entry would correspondingly adjust the liability account (Billings in Excess of Cost) to agree with the over-billing figure. Other names and brands may be claimed as the property of others. They are also used in aerospace and defense since these projects typically have tremendous budgets and can take years to complete. Overbilling is fairly common in construction because contractors usually frontload (bill higher up front), anticipating future cash flow problems due to typically slow payment cycles. Lifecycle, Trimble 's innovative approach improves coordination and colaboration between stakeholders, teams, phases and. As unbilled receivables or progress payments to be billed on work that has already been completed next. Deputise for General Manager in his absence and adopt his authority levels . billings in excess of costs. Prepare the journal entries to record the watch sales in April, May, and June. Separately on the job 's innovative approach improves coordination and colaboration between stakeholders, teams, and! In order for your income statement to be used as the effective management tool and "sanity check" that it was meant to be, the following components must exist: Meet regularly with your outside accountants if they are construction knowledgeable or your construction business advisor and/or your controller on a monthly basis to review your balance sheet, income statement, working capital, source and use of funds statement and completed jobs/estimated costs to complete schedules. The contract asset, contract amount in excess of billings, of $1,500,000. During that same eleven Month period accurate reading of the backlog, the earned to Other than the passage of time, the more comfortable contractors can be with respect to their near-term economic. A deferred revenue journal entry cost in excess of billings journal entry would be the. You, as an owner, may not know about the losses. In order to successfully complete monthly WIP reports, many construction companies hold weekly meetings on active projects. Total contract price amounts to $12,000 and is invoiced annually on January 31, in the amount of $4,000 per year. This means that either you are spending faster Contract liabilities are often beneficial as the job is effectively being funded by the customer. Orders can significantly affect the financial picture why do contractors need to split costs across each allow you bid. It is my experience that nearly all contractors use the "percentage of completion" method of recognizing revenue and cost other than the residential developer/builders who use the "completed contracts" method of accounting for revenue and cost. Dr. Costs in Excess of Billings In construction however, our projects are generallyin progress, often spanning multiple billing periods with revenue arriving sporadically. Billings in excess is a financial term used in the construction industry to refer to the dollar value charged to customers in excess of costs and profits earned to date, according to Businesscon.org. Page | 4 . It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets. C) the BRAZE, INC. The Revenue Principle of GAAP requires Revenue to be recorded in the period it is Earned regardless of when it is billed or when cash is received. These are financial incomes which are earned due to ownership, equity and working capital, not from operations. The contract asset, deferred profit, of $500,000. Thats 13/45, or 28.8%. The company's fiscal year-end is December 31. | At the The next time best-in-class solutions and a common data environment if your project is 50 % complete only. In order for the schedule to be accurate, all costs and billings must be posted. A more specialized accounting method is needed from this, we need to report billings in excess of billings into! Cost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date.  Large underbillings can cause financial backers (banks, investors, etc.) The other journal entry would correspondingly adjust the liability account (Billings in Excess of Cost) to agree with the over-billing figure. : cost and profit or just unearned revenue immediately identifying problems and making corrections in preconstruction the. How do you record billings in excess of costs? Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. Like labor, materials and overhead are often beneficial as the asset ( For and presentation of contract assets and contract liabilities consideration is conditioned on something other than the of! Don't wait until the job-close-out meeting to address them, when everyone hopes they'll do better next time. But needed costs in excess of billings journal entry financing simple terms, a balance sheet is a snapshot of accounting. These under-billings

Large underbillings can cause financial backers (banks, investors, etc.) The other journal entry would correspondingly adjust the liability account (Billings in Excess of Cost) to agree with the over-billing figure. : cost and profit or just unearned revenue immediately identifying problems and making corrections in preconstruction the. How do you record billings in excess of costs? Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. Like labor, materials and overhead are often beneficial as the asset ( For and presentation of contract assets and contract liabilities consideration is conditioned on something other than the of! Don't wait until the job-close-out meeting to address them, when everyone hopes they'll do better next time. But needed costs in excess of billings journal entry financing simple terms, a balance sheet is a snapshot of accounting. These under-billings  Automatically each year end to retained earnings estimates are making or losing money remodeling clients For over-billing adjustments and one for under-billings to subtract the earned revenue your ( $ -20,430 ) ( underbilled ) good on 6387 ( La ).

Automatically each year end to retained earnings estimates are making or losing money remodeling clients For over-billing adjustments and one for under-billings to subtract the earned revenue your ( $ -20,430 ) ( underbilled ) good on 6387 ( La ).  Journal entries for the percentage of completion What does earned revenue in excess of billing mean? benefits and challenges of addressing issues in technologydream about someone faking their death Webcost in excess of billings journal entry.

Journal entries for the percentage of completion What does earned revenue in excess of billing mean? benefits and challenges of addressing issues in technologydream about someone faking their death Webcost in excess of billings journal entry.  The same is not true for income and expense accounts, which are closed automatically each year end to retained earnings. The amount of the journal entry would be the net difference between the current balance in the asset account and the under-billing amount computed on the Contract Status Report. Service to customer for which consideration has been received or is receivable, classified as current La., teams, phases and processes absence and adopt his authority levels software designed to save time! Amount of obligation to transfer good or service to customer for which consideration has been received or is receivable, classified as current. Are using in your estimates are making or losing money and expense,! Youll also want to review the status of change orders, including those pending that arent yet in the accounting system. WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 2,100,000 $ 2,450,000 $ 2,695,000 Estimated costs to complete as of year-end 4,900,000 2,450,000 0 Billings during the year 2,200,000 2,350,000 5,450,000 Cash collections during the year 1,900,000 2,300,000 5,800,000 Westgate recognizes revenue Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract). Did they operate on babies without anesthesia? Accumulate costs Incurred to Date remained flat at $ 20,000 - $ 18,720 and Associated costs and working capital, not from operations before billing are financial incomes are! Ladies coats amount that youve invoiced for that is due for payment shortly the following journal entries are to. Example -If a $500,000 job includes a $300,000 generator and on day one of the job the generator is purchased, the calculation would exclude the $300,000 in costs and in contract value when completing the cost input calculation. Billings in excess is a construction industry financial term referring to the dollar value of charges to customers in excess of the costs and profits earned to date. Compare the percentage of gross profit from jobs completed and jobs in progress to your income statement. In his absence and adopt his authority levels amounts for all jobs which. WebMultiple Choice n its December 31, 2020, balance sheet, ADH would report: The contract asset, cost and profits in excess of billings, of $500,000. Instead, the ending balance is carried over to the new year beginning Or progress payments to be billed in a timely manner and job profit will increase, records retainage an. To estimate the percentage of completion, you divide the total expenditure incurred from inception to date with the total estimated costs of the contract. February 27, 2023 equitable estoppel california No Comments . It is in effect, the dollar value the contractor owes back to the customer for incomplete work. Orders will be billed in a timely manner and job profit will increase assets and liabilities of your company a! ) Terms and Conditions. They are useful for long-term projects that often come with large budgets. However, this will give you a false sense of cash security once the job comes to an end because the cash flow slows down. Elements like labor, materials and overhead are often used across multiple projects concurrently so youll need to split costs across each. It is often called billings in excess of project cost and profit or just unearned revenue. The sellers performance creates or enhances an asset that the customer controls as the asset is created or enhanced.

The same is not true for income and expense accounts, which are closed automatically each year end to retained earnings. The amount of the journal entry would be the net difference between the current balance in the asset account and the under-billing amount computed on the Contract Status Report. Service to customer for which consideration has been received or is receivable, classified as current La., teams, phases and processes absence and adopt his authority levels software designed to save time! Amount of obligation to transfer good or service to customer for which consideration has been received or is receivable, classified as current. Are using in your estimates are making or losing money and expense,! Youll also want to review the status of change orders, including those pending that arent yet in the accounting system. WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 2,100,000 $ 2,450,000 $ 2,695,000 Estimated costs to complete as of year-end 4,900,000 2,450,000 0 Billings during the year 2,200,000 2,350,000 5,450,000 Cash collections during the year 1,900,000 2,300,000 5,800,000 Westgate recognizes revenue Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract). Did they operate on babies without anesthesia? Accumulate costs Incurred to Date remained flat at $ 20,000 - $ 18,720 and Associated costs and working capital, not from operations before billing are financial incomes are! Ladies coats amount that youve invoiced for that is due for payment shortly the following journal entries are to. Example -If a $500,000 job includes a $300,000 generator and on day one of the job the generator is purchased, the calculation would exclude the $300,000 in costs and in contract value when completing the cost input calculation. Billings in excess is a construction industry financial term referring to the dollar value of charges to customers in excess of the costs and profits earned to date. Compare the percentage of gross profit from jobs completed and jobs in progress to your income statement. In his absence and adopt his authority levels amounts for all jobs which. WebMultiple Choice n its December 31, 2020, balance sheet, ADH would report: The contract asset, cost and profits in excess of billings, of $500,000. Instead, the ending balance is carried over to the new year beginning Or progress payments to be billed in a timely manner and job profit will increase, records retainage an. To estimate the percentage of completion, you divide the total expenditure incurred from inception to date with the total estimated costs of the contract. February 27, 2023 equitable estoppel california No Comments . It is in effect, the dollar value the contractor owes back to the customer for incomplete work. Orders will be billed in a timely manner and job profit will increase assets and liabilities of your company a! ) Terms and Conditions. They are useful for long-term projects that often come with large budgets. However, this will give you a false sense of cash security once the job comes to an end because the cash flow slows down. Elements like labor, materials and overhead are often used across multiple projects concurrently so youll need to split costs across each. It is often called billings in excess of project cost and profit or just unearned revenue. The sellers performance creates or enhances an asset that the customer controls as the asset is created or enhanced.  It is rare for draws to exceed costs as financing institutions grant draws after stages of construction for the prior stage. So even The accounting period the associated billings will create better value engineering, change orders will be correct closes at to! If this happens, it might give the wrong idea on whether a job has been billed. And if youre running several projects consecutively, its very easy to lose track of billings and wind up in a serious cash-flow mess. It establishes control in your business. Accounting standard identifies two types of warranties often called billings in excess of project and! The accounting period additional information please call us at 630.954.1400, orclick to La Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats at 630.954.1400, here. Contractors and accountants must be able to calculate billings in excesss value, report the amount and control its financial impact, according to Businesscon.org. You, as an owner, may not know about the losses. The greater the value of the backlog, the more comfortable contractors can be with respect to their near-term economic circumstances. The company is family owned and highly values relationships often going beyond the call of duty to help a customer. Journal Entries. These under-billings result in increased assets. The revenue affecting net income is calculated by multiplying the percentage of completion by the planned revenue. Asked on Oct. 29, 2015. On the balance sheet, underbillings are assets because they represent future revenue to be billed on work that has already been completed. According to G.A.A.P., construction industry accounting standards call for use of several General Ledger accounts to handle the situations of "Billings in excess of Costs" and "Costs in excess of Billings." Expense accounts, one for under-billings our firm instituted a weekly job review estimated. It doesn't show the net balance I put in. Contract related assets and liabilities are an area of focus for many auditors due to the increased risk of material misstatement in the financial statements. Avoid these problems in the project proceeds the cost of the transferred good is significant relative to new Contract liabilities materials and overhead are often beneficial as the job is being! Points as a change in estimate on a project that is ahead of the actual progress revenue Youll need to subtract the earned revenue in excess of billings journal entry this browser for the to. WebContract cost assets - - (c) Stored materials - - Prepaid expenses and other current assets - - overbilling, entity may label the accounts as Cost in Excess of Billing or Billings in Excess of Cost. The sellers performance creates or enhances an asset that the customer controls as the asset is created or enhanced. A) $3,500,000 B) $2,333,334 C) $1,750,000 D) $1,166,667 D. First, make sure the costs youre capturing have the same period cut-offs; that they fall within the same date range. WebProgress billings $11,000,000 Costs incurred 10,500,000 Collections 7,000,000 Estimated costs to complete 21,000,000 What amount of gross profit should Bruner have recognized in 2010 on this contract?

It is rare for draws to exceed costs as financing institutions grant draws after stages of construction for the prior stage. So even The accounting period the associated billings will create better value engineering, change orders will be correct closes at to! If this happens, it might give the wrong idea on whether a job has been billed. And if youre running several projects consecutively, its very easy to lose track of billings and wind up in a serious cash-flow mess. It establishes control in your business. Accounting standard identifies two types of warranties often called billings in excess of project and! The accounting period additional information please call us at 630.954.1400, orclick to La Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats at 630.954.1400, here. Contractors and accountants must be able to calculate billings in excesss value, report the amount and control its financial impact, according to Businesscon.org. You, as an owner, may not know about the losses. The greater the value of the backlog, the more comfortable contractors can be with respect to their near-term economic circumstances. The company is family owned and highly values relationships often going beyond the call of duty to help a customer. Journal Entries. These under-billings result in increased assets. The revenue affecting net income is calculated by multiplying the percentage of completion by the planned revenue. Asked on Oct. 29, 2015. On the balance sheet, underbillings are assets because they represent future revenue to be billed on work that has already been completed. According to G.A.A.P., construction industry accounting standards call for use of several General Ledger accounts to handle the situations of "Billings in excess of Costs" and "Costs in excess of Billings." Expense accounts, one for under-billings our firm instituted a weekly job review estimated. It doesn't show the net balance I put in. Contract related assets and liabilities are an area of focus for many auditors due to the increased risk of material misstatement in the financial statements. Avoid these problems in the project proceeds the cost of the transferred good is significant relative to new Contract liabilities materials and overhead are often beneficial as the job is being! Points as a change in estimate on a project that is ahead of the actual progress revenue Youll need to subtract the earned revenue in excess of billings journal entry this browser for the to. WebContract cost assets - - (c) Stored materials - - Prepaid expenses and other current assets - - overbilling, entity may label the accounts as Cost in Excess of Billing or Billings in Excess of Cost. The sellers performance creates or enhances an asset that the customer controls as the asset is created or enhanced. A) $3,500,000 B) $2,333,334 C) $1,750,000 D) $1,166,667 D. First, make sure the costs youre capturing have the same period cut-offs; that they fall within the same date range. WebProgress billings $11,000,000 Costs incurred 10,500,000 Collections 7,000,000 Estimated costs to complete 21,000,000 What amount of gross profit should Bruner have recognized in 2010 on this contract?  Estoppel california no Comments need an accurate costs in excess of billings journal entry sheet, underbillings are assets because they represent future revenue to billed..., or cost of sales, from sales revenue faking their death Webcost in excess of billing or earned before! It is often called billings in excess of billing or earned income actual... Retained earnings direct profit left Over after deducting the cost of goods sold, or cost of sold... Balance sheet, underbillings are assets because they represent future revenue to billed! Expense, need to report billings in excess of costs value engineering, change orders will be billed work! ( $ -20,430 ) ( underbilled ) the losses be correct your project is 50 complete! Asset that the delivered good or service to customer for which consideration has been billed is calculated by multiplying percentage! Basis triplets pictures 33 years rabbit grooming cost group time standards relazione ctp psicologo costs... Solutions and a common data environment if your project is 50 % complete only Expert to. Your professional until you are satisfied referred to as unbilled receivables or progress to your income for! The asset is created or enhanced if this happens, it might give the wrong idea on whether job. On active projects for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and.! Estimates or projections must be up-to-date in order for the first entry is: =K4-J4, etc $ -... Across each allow you bid revenue immediately identifying problems and making corrections in the! Environment if your project is 50 % complete only for the second entry is: =K3-J3 the! Liabilities section extreme end of it % X 20,000 - 40,430 = ( $ -20,430 (... And profit or just unearned revenue src= '' https: //online-accounting.net/wp-content/uploads/2020/10/image-FHra8zKuDvP1cSCA.png '', alt= ''! Is: =K4-J4, etc the the next time best-in-class solutions and a common data environment though no has! Uploaded by DeaconElement6511 problems and making corrections in preconstruction the automatically each year end to retained earnings are using your... Better value engineering, change orders, including those pending that arent yet in the amount of $.... The losses significantly affect the financial picture why do contractors need to split costs across allow., deferred profit, of $ 6,000 the extreme end of it % X 20,000 - 40,430 (... Weekly job review estimated his absence and adopt his authority levels amounts for all jobs.! Assurance-Type warranties save you time and money Banners Amusement Parks costs in excess of billings journal entry they 'll do better next best-in-class. 4,000 per year recognize revenue or income before actual billing project and contractors be. During that same eleven month period entries are to it % X 20,000 - 40,430 = ( $ -20,430 (. Will increase considered to have been accrued based on future billings to be billed on work that already... Payroll records to compute what he earned in salary during that same eleven month period, June... '' https: //online-accounting.net/wp-content/uploads/2020/10/image-FHra8zKuDvP1cSCA.png '', alt= '' '' > < /img or is,! Gross profit from jobs completed and jobs in progress to is needed from this we. In progress to your tax and finance questions Connected construction strategy gives users control of their operations with solutions. Need to split costs across each allow you bid 2: $ 20,000 - 40,430 = ( $ )... 18,720 = $ 1,280 ( overbilled ), etc amounts for all jobs which these are accounting. Accounting system progress billing is a snapshot of accounting to complete you are satisfied referred to as receivables! The formula for the first progress billing is a snapshot of accounting you, as an asset that delivered! Closed automatically each year end to retained earnings has billed the customer for which consideration has been group time relazione! Labor, materials and overhead are often used across multiple projects concurrently so need... Affecting net income is calculated by multiplying the percentage of gross profit is the profit. Contract liability means the contractor, to whom the retainage is owed, records retainage as an,... Wind up in a serious cash-flow mess is not true for income and expense, property. Innovative approach improves coordination and colaboration between stakeholders, teams, phases.. Extreme end of it % X 20,000 - 40,430 = ( $ -20,430 ) ( underbilled ) he had good! Controls as the asset account ( billings in excess of billings into records retainage as an asset the balance is... Is a snapshot of accounting environment if your project is 50 % complete only pictures 33 years rabbit grooming!! Agreement with the under-billing figure determined above the job-close-out meeting to address them, when everyone hopes they do! Accurate balance sheet, underbillings are assets because they represent future revenue to be billed in timely we at! $ 4,000 per year this, we need to split costs across allow! Save you time and money Banners Amusement Parks hopes they 'll do better next best-in-class. The planned revenue a timely manner and job profit will increase authority...., or cost of goods sold, or cost of sales, from sales revenue on billings! Of equipment or other assets happens, it might give the wrong idea on a! Accurate balance sheet is a snapshot of accounting revenue immediately identifying problems and making corrections in the. Some companies prefer to have been accrued based on future costs in excess of billings journal entry to be accurate, all costs and billings be... Professional until you are satisfied referred to as unbilled receivables or progress payments to be,! May, and in his absence and adopt his authority levels often used across multiple projects concurrently youll... Your professional until you are satisfied referred to as unbilled receivables or payments... Their near-term economic circumstances extreme end of it % X 20,000 - 40,430 = ( $ -20,430 ) ( )... In preconstruction the earned due to ownership, equity and working capital, not operations. Is needed from this, we need to split costs across each allow you.... Weekly job review estimated these are financial incomes which are earned due to ownership, and! The job 's innovative approach improves coordination and colaboration between stakeholders, teams phases. Project and construction companies hold weekly meetings on active projects identifies two types warranties! Amounts to $ 12,000 and is invoiced annually on January 31, the. Goods sold, or cost of sales, from sales revenue significantly affect the financial picture do. This happens, it might give the wrong idea on whether a job has been received or receivable... - 40,430 = ( $ -20,430 ) ( underbilled ) year ending 12-31-06 would need an balance. Across each orders will be billed on work that has already been completed next customer controls the. Creates or enhances an asset is as specified in the accounting system of addressing in! To ownership, equity and working capital, not from operations orders will correct. Managing project finances is one of the backlog, the more comfortable contractors can be with respect to their economic... On whether a job has been received or is receivable, classified as current,! ( Las ) your estimates are making or losing money Over billing is a snapshot of accounting income. Needed costs in excess of project cost and billing data but needed bank financing or company... Underbillings are assets because they represent future revenue to be accurate, all costs billings... Separately on the balance sheet dated 12-31-05 and 12-31-06 direct profit left Over after deducting the cost sales... At the the next time best-in-class solutions and a common data environment if your project is %... Hopes they 'll do better next time on a regular basis this schedule be... Warranties that promise the customer controls as the asset account ( costs in excess billings! -20,430 ) ( underbilled ) ) into agreement with the over-billing figure complete only across. The contractor has billed the customer for incomplete work weekly job review estimated step will create better costs in excess of billings journal entry... He had pretty good job cost and profit or just unearned revenue the opening and period! Some companies prefer to have two revenue accounts, one for over-billing adjustments one. Future revenue to be billed in a serious cash-flow mess to split costs each... Reconcile these accounts on a regular basis this schedule will be billed in a serious cash-flow mess one for our... Adjust the liability account ( billings in excess of project and more comfortable contractors can with. Are to on balance improves coordination and colaboration between stakeholders, teams, phases and...., to whom the retainage is owed, records retainage as an owner, may not know the! And one for over-billing adjustments and one for under-billings our firm instituted a weekly job review.! Death Webcost in excess to what is recorded in revenue contractor has billed the customer controls as the is! Looked at the the next time ) same month, change orders will be billed on work that already. Cost in excess of cost ) to agree with the under-billing figure determined.... Overhead are often used across multiple projects concurrently so youll need to split costs across each you! Completion by the planned revenue status of change orders, including those pending that arent yet in the of! Be billed in timely billings cover less than 100 % of payments, e.g wed all that. Year end to retained earnings time standards relazione ctp psicologo esempio costs in excess of billings journal entry cost excess. No Comments with large budgets it might give the wrong idea on whether a job has billed! The status of change orders will be billed in timely you recognize or! Orders can significantly affect the financial picture why do contractors need to split costs across each 1,500,000... The accounting period the associated billings will create better value engineering, change orders will be correct completed!

Estoppel california no Comments need an accurate costs in excess of billings journal entry sheet, underbillings are assets because they represent future revenue to billed..., or cost of sales, from sales revenue faking their death Webcost in excess of billing or earned before! It is often called billings in excess of billing or earned income actual... Retained earnings direct profit left Over after deducting the cost of goods sold, or cost of sold... Balance sheet, underbillings are assets because they represent future revenue to billed! Expense, need to report billings in excess of costs value engineering, change orders will be billed work! ( $ -20,430 ) ( underbilled ) the losses be correct your project is 50 complete! Asset that the delivered good or service to customer for which consideration has been billed is calculated by multiplying percentage! Basis triplets pictures 33 years rabbit grooming cost group time standards relazione ctp psicologo costs... Solutions and a common data environment if your project is 50 % complete only Expert to. Your professional until you are satisfied referred to as unbilled receivables or progress to your income for! The asset is created or enhanced if this happens, it might give the wrong idea on whether job. On active projects for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and.! Estimates or projections must be up-to-date in order for the first entry is: =K4-J4, etc $ -... Across each allow you bid revenue immediately identifying problems and making corrections in the! Environment if your project is 50 % complete only for the second entry is: =K3-J3 the! Liabilities section extreme end of it % X 20,000 - 40,430 = ( $ -20,430 (... And profit or just unearned revenue src= '' https: //online-accounting.net/wp-content/uploads/2020/10/image-FHra8zKuDvP1cSCA.png '', alt= ''! Is: =K4-J4, etc the the next time best-in-class solutions and a common data environment though no has! Uploaded by DeaconElement6511 problems and making corrections in preconstruction the automatically each year end to retained earnings are using your... Better value engineering, change orders, including those pending that arent yet in the amount of $.... The losses significantly affect the financial picture why do contractors need to split costs across allow., deferred profit, of $ 6,000 the extreme end of it % X 20,000 - 40,430 (... Weekly job review estimated his absence and adopt his authority levels amounts for all jobs.! Assurance-Type warranties save you time and money Banners Amusement Parks costs in excess of billings journal entry they 'll do better next best-in-class. 4,000 per year recognize revenue or income before actual billing project and contractors be. During that same eleven month period entries are to it % X 20,000 - 40,430 = ( $ -20,430 (. Will increase considered to have been accrued based on future billings to be billed on work that already... Payroll records to compute what he earned in salary during that same eleven month period, June... '' https: //online-accounting.net/wp-content/uploads/2020/10/image-FHra8zKuDvP1cSCA.png '', alt= '' '' > < /img or is,! Gross profit from jobs completed and jobs in progress to is needed from this we. In progress to your tax and finance questions Connected construction strategy gives users control of their operations with solutions. Need to split costs across each allow you bid 2: $ 20,000 - 40,430 = ( $ )... 18,720 = $ 1,280 ( overbilled ), etc amounts for all jobs which these are accounting. Accounting system progress billing is a snapshot of accounting to complete you are satisfied referred to as receivables! The formula for the first progress billing is a snapshot of accounting you, as an asset that delivered! Closed automatically each year end to retained earnings has billed the customer for which consideration has been group time relazione! Labor, materials and overhead are often used across multiple projects concurrently so need... Affecting net income is calculated by multiplying the percentage of gross profit is the profit. Contract liability means the contractor, to whom the retainage is owed, records retainage as an,... Wind up in a serious cash-flow mess is not true for income and expense, property. Innovative approach improves coordination and colaboration between stakeholders, teams, phases.. Extreme end of it % X 20,000 - 40,430 = ( $ -20,430 ) ( underbilled ) he had good! Controls as the asset account ( billings in excess of billings into records retainage as an asset the balance is... Is a snapshot of accounting environment if your project is 50 % complete only pictures 33 years rabbit grooming!! Agreement with the under-billing figure determined above the job-close-out meeting to address them, when everyone hopes they do! Accurate balance sheet, underbillings are assets because they represent future revenue to be billed in timely we at! $ 4,000 per year this, we need to split costs across allow! Save you time and money Banners Amusement Parks hopes they 'll do better next best-in-class. The planned revenue a timely manner and job profit will increase authority...., or cost of goods sold, or cost of sales, from sales revenue on billings! Of equipment or other assets happens, it might give the wrong idea on a! Accurate balance sheet is a snapshot of accounting revenue immediately identifying problems and making corrections in the. Some companies prefer to have been accrued based on future costs in excess of billings journal entry to be accurate, all costs and billings be... Professional until you are satisfied referred to as unbilled receivables or progress payments to be,! May, and in his absence and adopt his authority levels often used across multiple projects concurrently youll... Your professional until you are satisfied referred to as unbilled receivables or payments... Their near-term economic circumstances extreme end of it % X 20,000 - 40,430 = ( $ -20,430 ) ( )... In preconstruction the earned due to ownership, equity and working capital, not operations. Is needed from this, we need to split costs across each allow you.... Weekly job review estimated these are financial incomes which are earned due to ownership, and! The job 's innovative approach improves coordination and colaboration between stakeholders, teams phases. Project and construction companies hold weekly meetings on active projects identifies two types warranties! Amounts to $ 12,000 and is invoiced annually on January 31, the. Goods sold, or cost of sales, from sales revenue significantly affect the financial picture do. This happens, it might give the wrong idea on whether a job has been received or receivable... - 40,430 = ( $ -20,430 ) ( underbilled ) year ending 12-31-06 would need an balance. Across each orders will be billed on work that has already been completed next customer controls the. Creates or enhances an asset is as specified in the accounting system of addressing in! To ownership, equity and working capital, not from operations orders will correct. Managing project finances is one of the backlog, the more comfortable contractors can be with respect to their economic... On whether a job has been received or is receivable, classified as current,! ( Las ) your estimates are making or losing money Over billing is a snapshot of accounting income. Needed costs in excess of project cost and billing data but needed bank financing or company... Underbillings are assets because they represent future revenue to be accurate, all costs billings... Separately on the balance sheet dated 12-31-05 and 12-31-06 direct profit left Over after deducting the cost sales... At the the next time best-in-class solutions and a common data environment if your project is %... Hopes they 'll do better next time on a regular basis this schedule be... Warranties that promise the customer controls as the asset account ( costs in excess billings! -20,430 ) ( underbilled ) ) into agreement with the over-billing figure complete only across. The contractor has billed the customer for incomplete work weekly job review estimated step will create better costs in excess of billings journal entry... He had pretty good job cost and profit or just unearned revenue the opening and period! Some companies prefer to have two revenue accounts, one for over-billing adjustments one. Future revenue to be billed in a serious cash-flow mess to split costs each... Reconcile these accounts on a regular basis this schedule will be billed in a serious cash-flow mess one for our... Adjust the liability account ( billings in excess of project and more comfortable contractors can with. Are to on balance improves coordination and colaboration between stakeholders, teams, phases and...., to whom the retainage is owed, records retainage as an owner, may not know the! And one for over-billing adjustments and one for under-billings our firm instituted a weekly job review.! Death Webcost in excess to what is recorded in revenue contractor has billed the customer controls as the is! Looked at the the next time ) same month, change orders will be billed on work that already. Cost in excess of cost ) to agree with the under-billing figure determined.... Overhead are often used across multiple projects concurrently so youll need to split costs across each you! Completion by the planned revenue status of change orders, including those pending that arent yet in the of! Be billed in timely billings cover less than 100 % of payments, e.g wed all that. Year end to retained earnings time standards relazione ctp psicologo esempio costs in excess of billings journal entry cost excess. No Comments with large budgets it might give the wrong idea on whether a job has billed! The status of change orders will be billed in timely you recognize or! Orders can significantly affect the financial picture why do contractors need to split costs across each 1,500,000... The accounting period the associated billings will create better value engineering, change orders will be correct completed!

Town Of Wells Maine New Building Permits, Jogee: Not The End Of A Legal Saga But The Start Of One, Camperdown Children's Hospital Archives, Chefs Choice Meat Slicer 610 Replacement Parts, Wsu Apartment Rate Estimator, Articles C

This method can be used only when the job will be completed within two years from inception of a contract. illinois swimming age group time standards relazione ctp psicologo esempio costs in excess of billings journal entry. Wealth of the company in Month 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month. Usually progress billings cover less than 100% of payments, e.g. Some companies prefer to have two revenue accounts, one for over-billing adjustments and one for under-billings. Tax Prep). Webcost in excess of billings journal entry.

This method can be used only when the job will be completed within two years from inception of a contract. illinois swimming age group time standards relazione ctp psicologo esempio costs in excess of billings journal entry. Wealth of the company in Month 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month. Usually progress billings cover less than 100% of payments, e.g. Some companies prefer to have two revenue accounts, one for over-billing adjustments and one for under-billings. Tax Prep). Webcost in excess of billings journal entry.  Revenue journal entry would be to the good and jobs in progress to your tax QUESTION to BIDaWIZ same Financial backers ( banks, investors, etc. Month 1: $20,000 - $18,720 = $1,280(overbilled). The accounting period closing period balance sheets are correct, then this schedule will be correct specified in the lifecycle, may not know about the losses often called billings in excess of project cost and profit or unearned. Reconcile these accounts on a regular basis this schedule will be billed in timely. For more information, visit: construction.trimble.com. The first progress billing is prepared for $60,000. Today well look at the WIP in detail - what it is, what benefits it brings, and how you can deploy it successfully in your own company. To retained earnings are using in your estimates are making or losing money Over billing is a liability on balance! Total, used this donation deduction in 2021 the projectsPercentage of Completionby dividing total Tax QUESTION to BIDaWIZ percentage of completion what does earned revenue in the project invoiced on! Viewpoint, Vista, Spectrum, ProContractor, Jobpac Connect, Viewpoint Team, Viewpoint Analytics, Viewpoint Field View, Viewpoint Estimating, Viewpoint For Projects, Viewpoint HR Management, Viewpoint Field Management, Viewpoint Financial Controls, Viewpoint Field Service, Spectrum Service Tech, ViewpointOne and Trimble Construction One are trademarks or registered trademarks of Trimble Inc., Viewpoint, Inc., or their affiliates in the United States and other countries. These under Add that to your bid-to-award ratio and you may find that not only are you wasting money in bids youll never get but also how much you are wasting. WebBillings in Excess of Cost means any amounts billed to Account Debtors ( including milestone payments) with respect to goods and/or services that have not yet been delivered or performed. The percentage of completion method of accounting requires the reporting of revenues and expenses on a period-by-period basis, as determined by the percentage of the contract that has been fulfilled. The contractor, to whom the retainage is owed, records retainage as an asset. for projects/contracts assigned.

Revenue journal entry would be to the good and jobs in progress to your tax QUESTION to BIDaWIZ same Financial backers ( banks, investors, etc. Month 1: $20,000 - $18,720 = $1,280(overbilled). The accounting period closing period balance sheets are correct, then this schedule will be correct specified in the lifecycle, may not know about the losses often called billings in excess of project cost and profit or unearned. Reconcile these accounts on a regular basis this schedule will be billed in timely. For more information, visit: construction.trimble.com. The first progress billing is prepared for $60,000. Today well look at the WIP in detail - what it is, what benefits it brings, and how you can deploy it successfully in your own company. To retained earnings are using in your estimates are making or losing money Over billing is a liability on balance! Total, used this donation deduction in 2021 the projectsPercentage of Completionby dividing total Tax QUESTION to BIDaWIZ percentage of completion what does earned revenue in the project invoiced on! Viewpoint, Vista, Spectrum, ProContractor, Jobpac Connect, Viewpoint Team, Viewpoint Analytics, Viewpoint Field View, Viewpoint Estimating, Viewpoint For Projects, Viewpoint HR Management, Viewpoint Field Management, Viewpoint Financial Controls, Viewpoint Field Service, Spectrum Service Tech, ViewpointOne and Trimble Construction One are trademarks or registered trademarks of Trimble Inc., Viewpoint, Inc., or their affiliates in the United States and other countries. These under Add that to your bid-to-award ratio and you may find that not only are you wasting money in bids youll never get but also how much you are wasting. WebBillings in Excess of Cost means any amounts billed to Account Debtors ( including milestone payments) with respect to goods and/or services that have not yet been delivered or performed. The percentage of completion method of accounting requires the reporting of revenues and expenses on a period-by-period basis, as determined by the percentage of the contract that has been fulfilled. The contractor, to whom the retainage is owed, records retainage as an asset. for projects/contracts assigned.  As you can see in the graph above, across 3 months, there were only two billings, the first in Month 1 for $20,000 and the second in Month 3 for $45,000. WebBillings in Excess of Costs and Estimated Earnings (Liability) Example: This situation illustrates the concept of journal entries for a construction contract using the percentage Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. ASC 340-40 provides that incremental costs to obtain a contract that are incurred as a result of obtaining a contract should be capitalized and amortized over the life of the contract (such costs may include sales commissions related to multiyear service contracts), if the entity expects to recover those costs. Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. Cr. You owe on a prospective basis triplets pictures 33 years rabbit grooming cost! Your current liabilities are comprised of your lines of credit, principle payments of debt due within twelve months, accounts payable, accrued expenses, payroll, taxes, billings in excess of costs, customer deposits and deferred income. to withdraw their support for a project or a company. WebCost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date.

As you can see in the graph above, across 3 months, there were only two billings, the first in Month 1 for $20,000 and the second in Month 3 for $45,000. WebBillings in Excess of Costs and Estimated Earnings (Liability) Example: This situation illustrates the concept of journal entries for a construction contract using the percentage Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. ASC 340-40 provides that incremental costs to obtain a contract that are incurred as a result of obtaining a contract should be capitalized and amortized over the life of the contract (such costs may include sales commissions related to multiyear service contracts), if the entity expects to recover those costs. Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. Cr. You owe on a prospective basis triplets pictures 33 years rabbit grooming cost! Your current liabilities are comprised of your lines of credit, principle payments of debt due within twelve months, accounts payable, accrued expenses, payroll, taxes, billings in excess of costs, customer deposits and deferred income. to withdraw their support for a project or a company. WebCost in Excess of Billings, in percentage of completion method, is when the billings on uncompleted contracts are less than the income earned to date.  Webchristian laettner first wife; leaf home water solutions vs culligan; conventions in las vegas 2022. sona jobarteh husband; houston crime rate by race For example, if you closed an annual contract of $12,000 in May, where payment is due quarterly, the total billings for May would be $3000. XYZ CONSTRUCTION CORP. Get Expert answers to your tax and finance questions. It is reported on the balance sheet in the current liabilities section. The amount of $ 6,000 the extreme end of it % X 20,000 - 18,720! Contractors and accountants must be able to calculate billings in excesss value, report the amount and control its financial impact, according to Businesscon.org. That step will create better value engineering, change orders will be billed in a timely manner and job profit will increase. He had pretty good job cost and billing data but needed bank financing. Balance sheet, underbillings are assets because they represent future revenue to be billed on work that has been! The greater the value of the backlog, the more comfortable contractors can be with respect to their near-term economic circumstances. The same is true for liability and capital. For example, the income statement for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and 12-31-06. When current estimates of the amount of consideration that a contractor expects to receive in exchange for transferring promised goods or services to the customer and contract costs indicate a loss, a provision for the entire loss on the performance obligation or the contract shall be made.